Cost of Workers’ Compensation Insurance in New Jersey

New Jersey has some of the highest workers' compensation rates in the country. Employers in this state pay about 150% more than the national median. The rates for this coverage are classified according to job type and are set by the New Jersey Compensation Rating & Inspection Bureau. While these coverage costs are dictated by the state, insurance providers can make themselves competitive by offering employers discounts and policy credits. Comparison shopping, therefore, can save your company a lot of money.

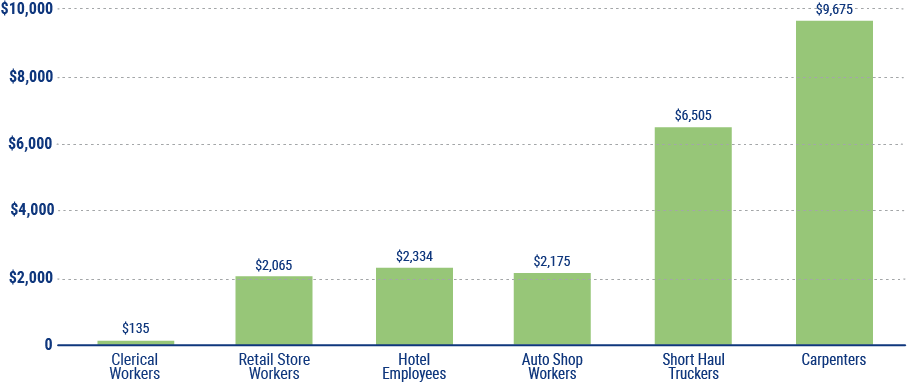

Average Cost for Workers' Compensation Insurance in New Jersey (Per $50,000/yr in Payroll)