Retail stores are one of the most popular businesses in the United States and every business needs to be protected from potential risks with the proper business insurance.

It's important to have the right coverage because the wrong incident could close your doors. A New Jersey independent insurance agent will talk to you about your business and help you secure the best retail store insurance. Here are some things to take into consideration.

What Is Retail Store Insurance?

Retail store insurance is business insurance for a type of store that sells goods to customers. Retail stores come in all shapes and sizes and need several insurance policies to be fully covered.

New Jersey business owners not only need insurance that protects their store and their inventory, but also coverage against liability claims or theft. Retail store insurance is a blend of different coverages that protect your retail store from top to bottom, inside and out.

What Does Retail Store Insurance Cover in New Jersey?

You'll want your retail store insurance to cover your store from any potential risks that could result in a physical or financial loss for your business. This will look different for different companies. Some companies may use vehicles, some may have heavy foot traffic, and some may be online-based.

Depending on the type of retail store you have, the following coverages are the most common:

- General liability insurance: Pays for any liability claims for third-party bodily injury or property damage. This includes on-site or when a customer is using an item you sell.

- Commercial property insurance: Pays to repair or replace damaged structures, contents, furniture, equipment, and fixtures if caused by a fire, storm, or similar.

- Commercial auto: Pays for bodily injury or property damage that is sustained while you or your employees are driving a company vehicle.

- Business interruption insurance: Helps replace income loss and cover expenses if you have to temporarily close your doors to recover from property damage.

- Workers' compensation: New Jersey requires that all businesses not covered by federal programs carry workers' compensation. This helps pay for any injuries or lost wages an employee sustains on the job.

"Most retail stores can be covered under a standard New Jersey business owner's policy," said insurance expert Jeffrey Green. "Some exceptions would be a jewelry store or other high-value specialty retailer who would not qualify for a BOP," he explained.

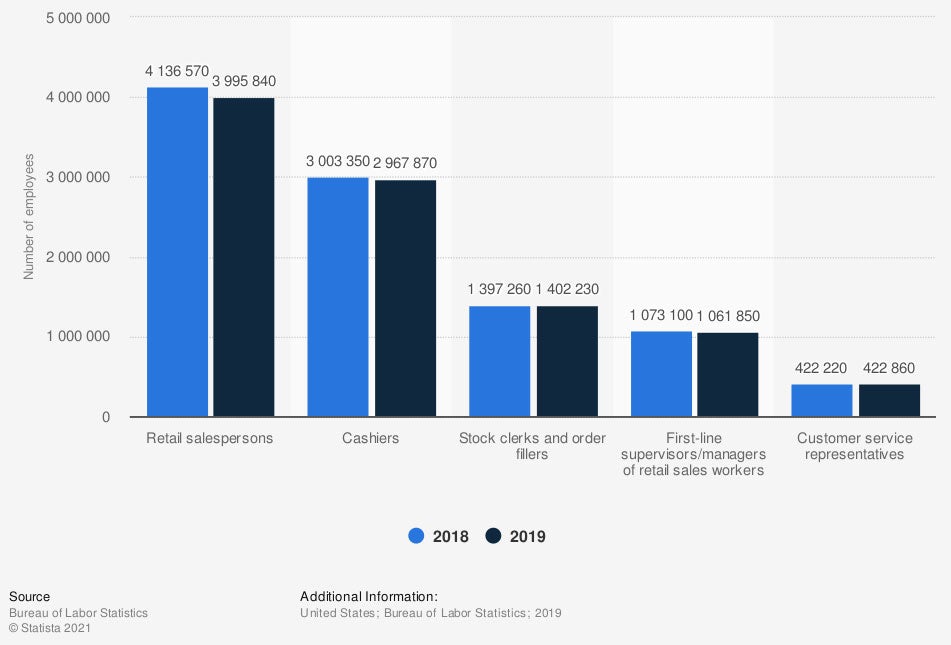

Number of retail store employees in the US in 2019

In 2019, there were more than 9.6 million people employed in retail stores in the US.

What Doesn't Retail Store Insurance Cover in New Jersey?

The most common exception in standard retail store insurance is coverage for flooding and earthquakes. Both of these events require independent insurance in order for a claim to be covered.

A New Jersey independent insurance agent can help you purchase flood insurance, which is recommended for businesses if you're located in a flood zone.

Additional exclusions for retail store insurance include:

- General wear and tear

- Damage by improper maintenance

- Damage from nuclear war

- Any customer property that is stored at your business

- Intentional and fraudulent acts

It's important to sit down with your insurance agent and discuss all aspects of operating your business. Retail store insurance is highly customizable, but you will only receive coverage for the things you select. An agent can make sure there are no gaps in your coverage.

How Much Theft Is Covered with New Jersey Retail Store Insurance?

Theft is a common risk for businesses, not only by customers, but also by employees. Fortunately, your retail store insurance includes coverage for theft.

You'll want to work with your New Jersey independent insurance agent to determine the value of the assets in your store. They'll make sure that your policy limits will pay to fully replace stolen items or goods. If you should need to file a theft claim, you will only owe your deductible and your policy will pay out up to your agreed-upon policy limits.

New Jersey experiences 118,637 property crimes per year.

Do I Need Valuable Items Coverage In New Jersey?

While standard New Jersey business insurance policies provide comprehensive coverage, the limits may not be sufficient if you are selling high-value items like jewelry or artwork.

In this scenario, you may need to purchase a floater policy or add-on. These additional coverages increase the amount of coverage you have and are designed to cover valuable items that may be excluded in standard business insurance.

Your insurance agent will be able to tell you if the items you have in your retail store may be excluded from your general policy. If so, they can get you the coverage you need.

Will My Location Impact My Retail Store Insurance Rates in New Jersey?

Yes, location plays a major factor when determining insurance premiums for businesses. Particularly in New Jersey, businesses located along the coast in locations like Ocean City will see higher premiums than those that are inland. This is because coastal businesses are at a greater risk of hurricane damage.

Insurance carriers will also take into consideration how close your business is located to a fire station, theft rates for your city, and potential for natural disasters. All of these risks determine the likelihood of your business filing a claim.

The more likely you are to file a claim, the more coverage you need and the higher your insurance premiums will be.

Most common natural disasters in New Jersey

- Severe storms

- Tropical storms and hurricanes

- Floods

- Winter storms

- Wildfires

- Extreme heat and drought

How Can a New Jersey Independent Insurance Agent Help?

There are more than 884,000 small businesses in New Jersey and each one needs a unique blend of insurance coverage. Retail stores, in particular, have to worry about their storefront, the contents inside, and the people working for them.

A New Jersey independent insurance agent will talk to you about your retail store, free of charge. They understand where to purchase insurance and the best combination of coverages that will best protect you and your store.

Author | Sara East

Article Reviewed by | Jeffery Green

https://www.nj.gov/labor/wc/workers/workers_index.html

Callout stat: https://www.neighborhoodscout.com/nj/crime

https://crisisequipped.com/what-natural-disasters-occur-in-new-jersey/

© 2025, Consumer Agent Portal, LLC. All rights reserved.