Like it or not, your produce store is vulnerable to all kinds of threats on a daily basis. From fires to vandalism and beyond, you never know when disaster might befall your business. That’s why it’s so important to be prepared ahead of time with the right produce store insurance.

Fortunately a New Jersey independent insurance agent can help you find the right kind of produce store insurance for your business. They’ll also get you equipped with the proper coverage long before you ever need to file a claim. But before we jump too far ahead, here’s a closer look at this important coverage.

What Is Produce Store Insurance?

Basically a special type of New Jersey business insurance, produce store insurance is designed to protect produce stores and their owners from disaster. Coverage provides the basics of business insurance, such as income and property protection, and then gets topped off with specifics tailored to your produce store. A New Jersey independent insurance agent can help you find the best coverage to meet your business’s needs.

What Does Produce Store Insurance Cover in New Jersey?

Your produce store's policy might vary from your competitor’s around the block. But some of the most common coverages in produce store insurance include:

- Commercial general liability: Your produce store needs protection against lawsuits filed by third parties for claims of bodily injury or property damage caused by your business.

- Commercial property: Your produce store also needs protection for its physical structure and inventory against disasters like fire, storms, and more.

- Business income: Of course, your produce store needs protection for its revenue. Business income coverage allows a continuation of income and employee wages during temporary closures due to covered perils, like fire, natural disasters, etc.

- Workers’ compensation: Your produce store’s employees need their own protection in case they get injured, become ill, or die due to work-related activities.

A New Jersey independent insurance agent can further explain the common basic coverages often included in produce store insurance packages.

Additional Coverages for Produce Stores in New Jersey

After you get the basic coverages out of the way, it’s time to customize your produce store insurance package to best meet your needs. According to insurance expert Paul Martin, there are several coverages that produce store owners in New Jersey often choose to add, including:

- Crime insurance: Protects produce stores against employee or criminal theft of their income.

- Cyber liability insurance: Protects your business’s electronic data and computer systems from cybercriminals and data breaches.

- Commercial auto insurance: Protects your produce store’s vehicle fleet against theft, storm damage, and more.

- Commercial umbrella insurance: Protects your produce store against hefty lawsuits which could exhaust your general liability coverage limits.

Your New Jersey independent insurance agent can help you determine which additional coverages would most benefit your specific produce store.

What Are the Biggest Threats to My Produce Store?

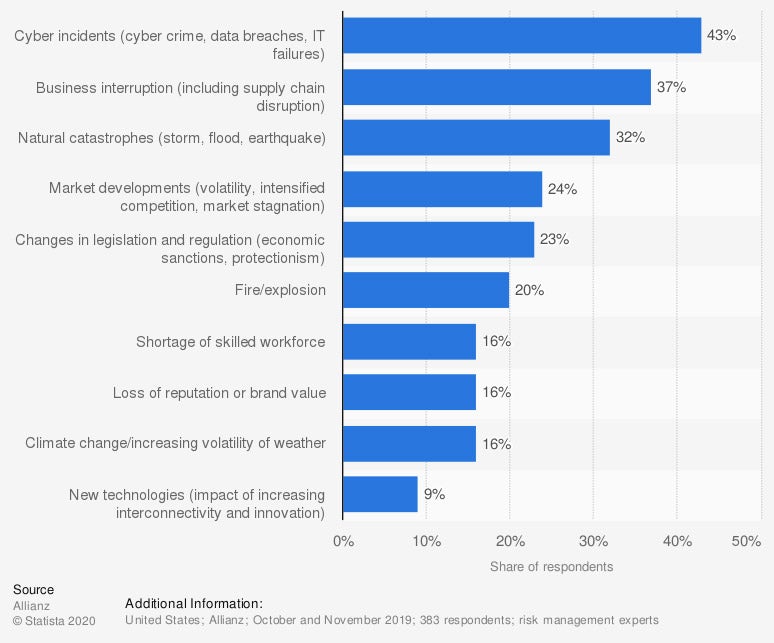

Before shopping for coverage, it’s helpful to know what risks you need to consider coverage for the most. Check out the biggest threats to businesses in the US and see for yourself.

Leading risks to businesses in the US in 2020

As of 2020, the greatest threat to businesses in the US overall, by far, was cyber incidents, including data breaches, IT failures, and cybercrimes. Business interruptions were the second-highest threat, followed by natural catastrophes like flooding and earthquakes.

A New Jersey independent insurance agent can help you assemble a produce store insurance package that accounts for these threats and more.

What Doesn’t Produce Store Insurance Cover in New Jersey?

Martin said that while produce store insurance provides a lot of important coverages, it also typically excludes the following risks:

- Routine maintenance costs

- Nuclear or war damage

- Employee dishonesty

- Flood or earthquake damage

In New Jersey, a coastal state, it’s important to consider adding flood insurance to your produce store coverage. Flood insurance is a separate policy that your New Jersey independent insurance agent can help you find.

How Much Does Produce Store Insurance Cost in New Jersey?

While some produce stores could pay only a couple hundred dollars annually for their policies, others could pay several thousand or even more. It really depends on a lot of factors, like:

- The number of employees you have

- Your business’s unique risks

- The size of your business

- Your business’s annual revenue

- Your specific location

Your New Jersey independent insurance agent can help you determine a more exact cost of produce store insurance in your area.

Here’s How a New Jersey Independent Insurance Agent Can Help

When it comes to protecting produce store owners against liability risks, property damage, and all other disasters, no one’s better equipped to help than an independent insurance agent. New Jersey independent insurance agents search through multiple carriers to find providers who specialize in produce store insurance, deliver quotes from several sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/422203/leading-business-risks-usa/

https://www.iii.org/article/cyber-liability-risks

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/insurance-for-specific-businesses/small-retail-stores

© 2025, Consumer Agent Portal, LLC. All rights reserved.