Life insurance is the only type of insurance that you purchase for someone else. In the event of your death, your loved ones could be left with hefty funeral costs and covering the financial loss from your income. New Jersey life insurance can provide some relief from these financial burdens.

There are several options when it comes to life insurance policies, which we'll explain more below, but a New Jersey independent insurance agent can help you understand which option best fits your needs.

What Is Life Insurance?

Life insurance for New Jersey residents is a type of insurance policy that pays monetary benefits to a beneficiary in the event of the insured person's death.

Similar to other insurance policies, you pay a monthly or yearly premium for your life insurance policy. Whether you die of old age or unexpectedly, your beneficiary will receive the determined payout of the life insurance policy.

This money can be used for funeral costs, expenses, bills and other death-related costs.

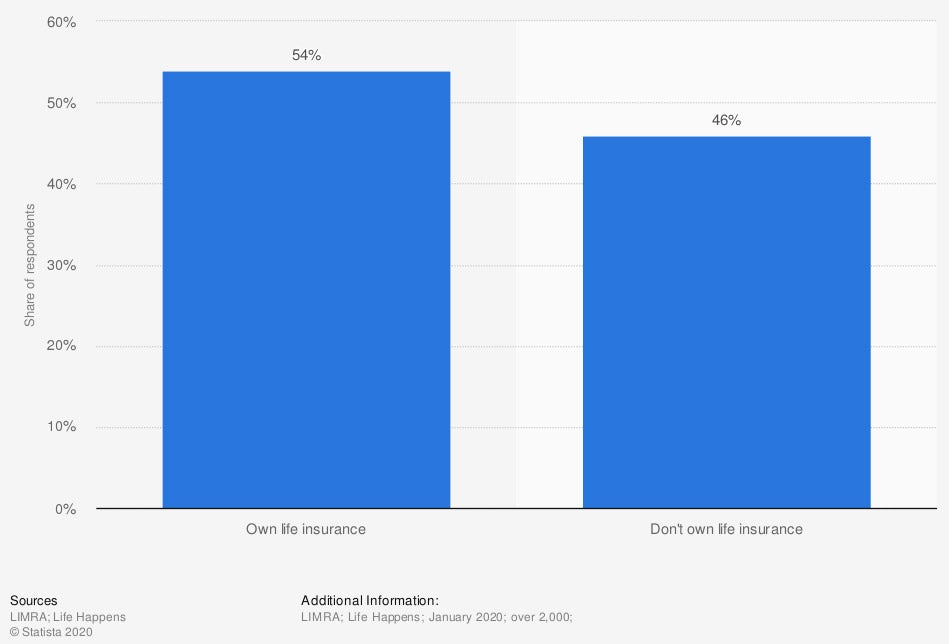

Distribution of life insurance ownership in the US in 2020

In 2020, 54% of Americans owned life insurance.

What Does Life Insurance Cover in New Jersey?

Funeral costs in New Jersey are not cheap. In fact, average New Jersey funerals can cost between $4,397 and $13,243, depending on how elaborate the funeral and burial are.

Life insurance covers, not only expenses related to a funeral, but other financial responsibilities and costs that your loved ones may incur upon your death. This includes:

- End-of-life expenses

- Monthly bills

- Everyday expenses

- Co-signed debt

- Childcare

- College tuition or education

Not only can life insurance serve as a safety net for your loved ones, but it can also be used to set up an inheritance for your children.

What Doesn't Life Insurance Cover in New Jersey?

Whether you're needing to replace income or keep your dependents out of debt when you die, life insurance covers most death events. However, there are a few exclusions to be aware of.

- An inactive policy: Often life insurance is purchased on a "term" basis for a specific amount of years. Once that term is up, you must renew the policy. If you forget to do so or you stop making payments, your policy will become inactive and your beneficiaries will not receive payment when you die.

- Suicide: Most life insurance policies will have a suicide clause that provides a specific time frame of excluded coverage in the event of a suicide. This is typically two years, since insurance companies do not want to give policyholders an incentive to take their life.

- Fraud or criminal activity: If your death is the result of illegal or fraudulent activity, it's fair to assume that your life insurance policy will not pay out to your beneficiaries.

Your New Jersey independent agent can help you understand the different coverages in your life insurance policy and when your beneficiaries may or may not receive a payout.

How Much Is Life Insurance in New Jersey?

The cost of a life insurance policy for New Jersey residents will depend on a variety of factors. The first is whether you purchase a term or whole life insurance policy, for which we will provide details shortly. Other factors include:

- Age

- Health

- Term length

- Sex

- Health

- Family medical history

When you purchase life insurance, you'll be asked a series of questions related to your health and daily habits. All of this information helps an insurance company determine your risk of dying. The lower your risk, the more affordable your policy.

Fortunately, life insurance is typically an inexpensive insurance policy. Premiums can start from as little as $10/month. Your New Jersey independent insurance agent can help you break down the costs of different policies and provide policy quotes.

What Is Whole Life Insurance vs. Term Life Insurance?

Not all life insurance policies are the same. In fact, you'll have a few different options to choose from, and depending on your age and current situation, one policy may make sense over the other.

The two main types of life insurance policies are whole and term. The difference between these two policies is described in their names. Whole life insurance covers you for your whole life, while term life insurance is for a specific number of years.

- Term insurance: You'll pick 10, 20, or 30 years, and if you die within the designated term, your beneficiary receives the payout. This policy can be renewed once the term is up.

- Whole life insurance: Also referred to as permanent insurance, this policy is intended to extend your entire life. A whole life insurance policy will also include a cash savings option that can accrue money over your lifetime.

The savings account of a whole life insurance policy can be accessed through withdrawal or even borrowed against. If you do decide to utilize the cash account, you'll want to make sure to purchase a policy rider that says your beneficiary receives the cash value and face value of the death benefit if you die. Otherwise, the cash value will be absorbed by the insurance company.

What Is a Universal Life Insurance Policy?

Universal life insurance is similar to whole life insurance, in that it's designed to last your entire life, and it includes a cash value account.

The biggest difference is that a universal life policy can accrue interest. Often, policyholders will add more money than they owe on the premium in order to take advantage of the interest aspect.

Adding extra money to your policy means you can skip payments if you need to, and you still receive access to the cash value the same as on a whole life policy.

Where Can I Purchase Life Insurance in New Jersey?

The easiest place to start with purchasing life insurance is with your New Jersey independent insurance agent. Independent agents make up more than 50% of life insurance distributors.

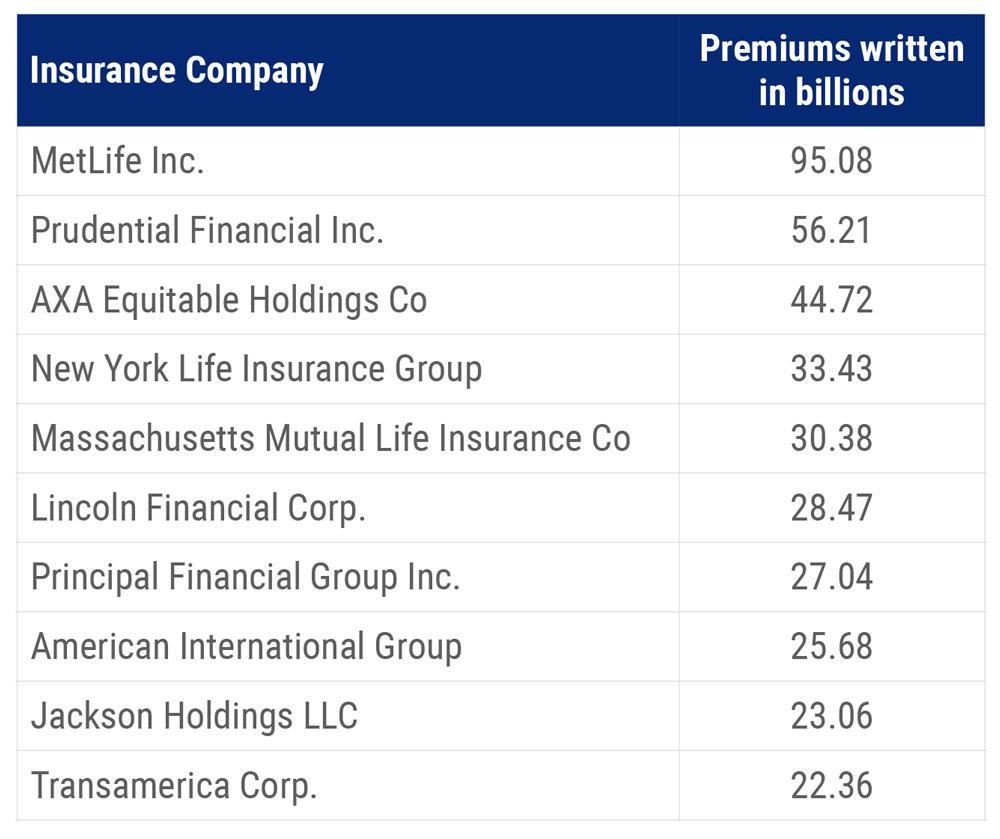

Your agent will be familiar with the top providers of life insurance in New Jersey. Nationwide, the following companies are the leading writers of life insurance policies.

How an Independent Insurance Agent in New Jersey Can Help

More than $120 billion of life insurance purchases are made in New Jersey every year. Planning for your death is not an exciting conversation, but it's an important step in financial planning.

When making sure that your loved ones will be financially secure if you die, a New Jersey independent insurance agent can help you understand and shop life insurance policies.

They've worked with a variety of companies and can walk you through the application process and choose a policy that will serve you and your loved ones while you're alive and long after you're gone. Work with an independent insurance agent in New Jersey today.

Author | Sara East

Article Reviewed by | Paul Martin

https://www.state.nj.us/dobi/division_consumers/insurance/life.htm

https://www.lhlic.com/consumer-resources/new-jersey-insurance/

https://www.nj.gov/dobi/division_insurance/index.htm

© 2025, Consumer Agent Portal, LLC. All rights reserved.