A lot of different varieties of fruits and vegetables are produced on New Jersey farmland every year. As a farmer, severe weather and agricultural prices can have a major effect on your production. That is why you need the proper farm insurance for your fruit crops.

Crop insurance is a unique type of farm and ranch insurance that has purchasing guidelines. A New Jersey independent insurance agent can help you understand the details and deadlines for getting this important coverage.

What Is Fruit Crop Insurance?

Fruit crop insurance is a type of federal insurance that protects farmers and ranchers from any losses that occur during the crop year.

Crop insurance is managed by the USDA Risk Management Agency (RMA). They partner with a variety of private insurance companies to provide crop insurance policies.

"The government knows that severe weather is a major threat to crops," said insurance expert Paul Martin. "It's like flood insurance. They know losses are going to happen, so they've created a federal type of policy to provide easy access to coverage."

What Does Fruit Crop Insurance Cover in New Jersey?

Fruit crop insurance covers a variety of fruits against specific risks. In New Jersey, fruit crop insurance covers apples, blueberries, cranberries, grapes, and peaches. Other fruits may be covered in specific counties.

In order for fruit crop insurance to cover a loss, it must be due to an unavoidable event. The following risks are typically covered:

- Drought

- Freezing

- Floods

- Fire

- Insects

- Diseases and wildlife

- Loss of revenue due to a decline in crop price

Fruit crop insurance can only be purchased at specific times throughout the year and must be purchased by RMA's seasonal deadlines. Your New Jersey independent insurance agent can help you understand the required time frame for purchasing coverage.

Why farmers in New Jersey need crop insurance

- 9,900 farms

- 750,000 acres of farmland

- 151, 767 acres covered by crop insurance

- $85.4 million in crop protection

- $4.2 million to cover crop losses

- $1.7 million paid by farmers for crop insurance

What Doesn't Fruit Crop Insurance Cover In New Jersey?

Even though fruit crop insurance is available for more than 120 crops, not every fruit is covered in every county of New Jersey. Other things that will be excluded from your fruit crop insurance plan include:

- Hail damage: This type of loss must be claimed under a crop-hail insurance policy, which is purchased separately from a fruit crop insurance policy.

- All floods: Some flooding events, including any harvested crops that are being stored in bins and destroyed by flooding, are not covered.

Your New Jersey independent insurance agent can help you understand what is and isn't covered in your fruit crop insurance policy.

Do I Need Farm and Ranch Insurance to Be Fully Covered In New Jersey?

While fruit crop insurance is recommended coverage for your crops, a farm has many valuable things that need protection. A New Jersey farm insurance policy will provide comprehensive coverage for a variety of risks, including liability and property damage claims.

Additional farm and ranch insurance coverage to consider

- Crop-hail insurance

- Flood insurance

- Equipment breakdown insurance

- Cattle ranch insurance

- Business interruption insurance

The above add-ons are worth discussing with your independent insurance agent when building your farm insurance package. You'll also have the ability to choose what specific risks are covered.

Common Risks to New Jersey Fruit Crops

Fruit farmers in New Jersey are faced with a variety of risks that can lead to crop failure. Crop failure is the complete loss of a marketable crop on a farm. These are the most common risks to New Jersey fruit crops.

- Severe weather: New Jersey experiences drought, lightning, hail, and severe storms. In the past, severe weather patterns have resulted in up to $50,000 in crop damage.

- Insects and pests: Fruit crops are susceptible to a variety of insects, such as fruit flies.

- Disease outbreaks: E. coli (STEC), Salmonella, norovirus and Listeria monocytogenes are all foodborne illnesses that have been linked to fruit crops.

Once a fruit crop experiences one of the above risks, it can no longer be harvested for sale. This kind of loss could cost your farm thousands of dollars, which is why it's important to purchase fruit crop insurance.

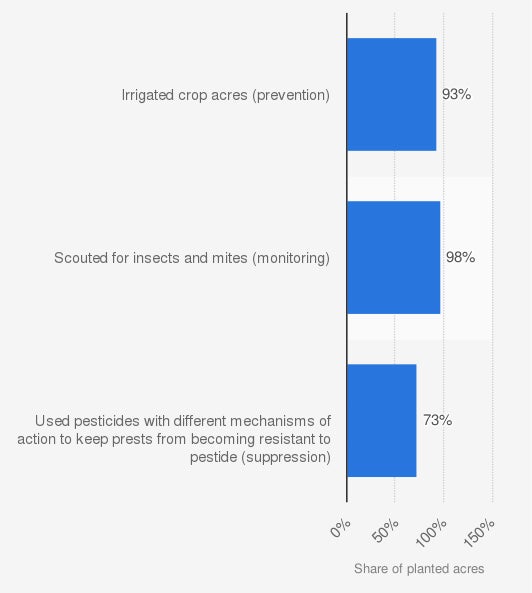

Pest management practices in the US for fruit crops 2019

Pest management is key to protecting your fruit crops. In 2019, 93% of farmers used irrigated crop acres for pest management.

How a New Jersey Independent Insurance Agent Can Help

There are more than 9,000 farms in New Jersey and fruit crops are a common agricultural commodity. Protecting your crops takes more than purchasing farm insurance. A New Jersey independent insurance agent understands the variety of fruit crop insurance options available and where to find coverage.

Working with an agent will save you time and money, and you can be assured that you have the best coverage available.

Author | Sara East

Article Reviewed by | Paul Martin

https://plant-pest-advisory.rutgers.edu/november-deadline-nears-for-fruit-crop-insurance-in-nj/

https://fruitgrowersnews.com/article/growers-need-crop-insurance-to-be-more-transparent/

https://www.rma.usda.gov/

https://www.iii.org/article/understanding-crop-insurance

© 2026, Consumer Agent Portal, LLC. All rights reserved.