For most New Jersey farmers, their home and farm land easily become intertwined. This means you need protection that will cover any personal or business liabilities.

Farm land liability insurance is a unique type of farm and ranch insurance that can be customized to fit your needs. For this reason, working with a New Jersey independent insurance agent who understands these policies can streamline the purchasing process.

What Is Farm Land Liability Insurance?

Farm land liability insurance combines the benefits of business insurance and homeowners insurance in order to provide coverage for bodily injury and property damage that occur anywhere on your land.

"Farmers have business exposures on their ranch or farm and normal family exposures with their home, so farm land liability is written as one big policy that covers both," explained insurance expert Paul Martin.

New Jersey farm land

- 9,900 farm operations

- 750,000 farm acres operated

- 76 farm areas operated

What Does Farm Land Liability Insurance Cover In New Jersey?

Injuries and property damage can happen on or off your farm. Farm land liability is designed to cover a variety of situations that may result in third-party bodily injuries or damage to another person's property.

Farm land liability can help pay for claims related to the following incidents:

- Bodily injury on your farm or in your home: Pays any legal fees and medical bills if someone, other than an employee, is injured while visiting your farm or your home.

- Bodily injury caused by your farm animals: Will pay if an animal breaks out of your property and injures another person.

- Property damage on your farm or in your home: Pays for any third-party property damage or financial loss caused by your farm or home operations.

- Property damage caused by your farm animals: Similarly, if an animal gets out of your farm and breaks a fence or damages a vehicle, farm land liability will pay to repair the damage.

- Fire damage: If a structure catches on fire on your farm or in your home, it will pay for any losses.

Farmers will have the option to add liability coverages such as pollution or farm chemicals liability to their policy. Your New Jersey independent insurance agent can provide you with a list of other coverages that are available.

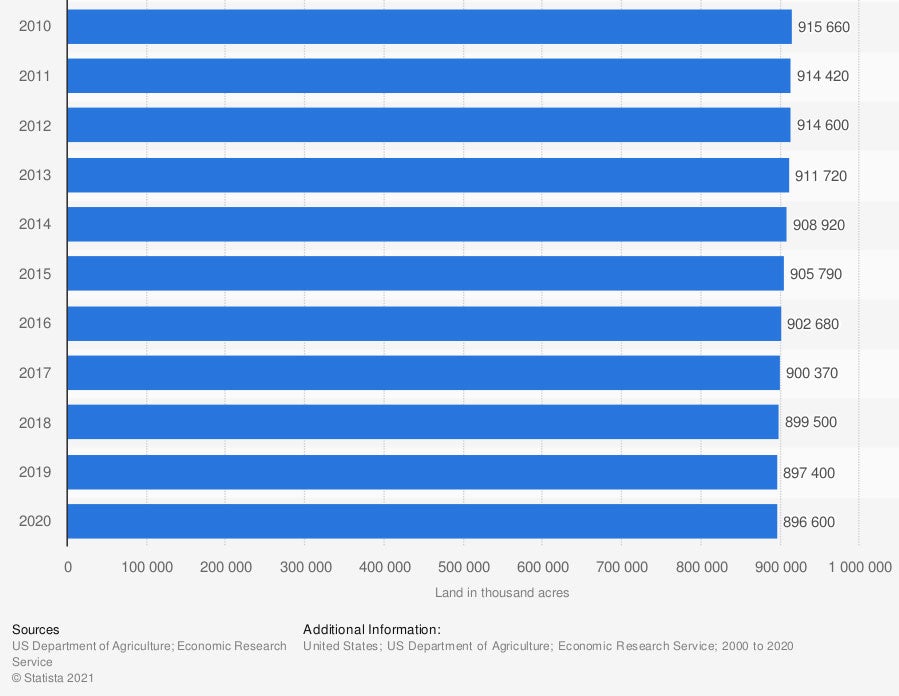

Total area of land in United States farms

In 2020, farms in the US occupied a total area of 896 million acres. Total farm land in the US has been decreasing over the last 20 years.

What Doesn't Farm Land Liability Insurance Cover in New Jersey?

Like any business, farmers need a variety of coverages to fully protect their assets and operations. Farm land liability insurance is specifically designed to protect against third-party incidents, which will leave your farm exposed in the following areas.

- Personal and employee injuries: Any employee injuries will be covered by a New Jersey workers' compensation plan. This is required by all New Jersey businesses that have employees and are not part of a federal program.

- Damage caused by flooding: Flood coverage is not included in any standard business insurance policy. You can purchase flood insurance separately if your farm is located in a flood zone.

- Farm equipment: It's likely your farm uses a variety of equipment to operate successfully. A farm equipment breakdown policy is needed if you want coverage on your machinery.

- Crops: Any damage that occurs to your crops will require crop insurance or crop-hail insurance to be covered.

- Auto coverage: Damage caused by company vehicles is not covered under a farm land liability policy. You can purchase commercial auto insurance if you have company vehicles you use for operations.

Gaps in coverage can lead to costly claims should an accident occur on your farm. When building your insurance package with your agent, they'll explain any exclusions in your policy that you should be aware of.

How Much Does Farm Land Liability Insurance Cost In New Jersey?

With 9,883 farms spanning across 734,000 acres of New Jersey, farm land comes in all shapes and sizes. Insurance companies will consider multiple factors when determining the cost of your farm land liability insurance.

- Frontage feet: Frontage is how much property you have that faces a road. For insurance companies, this type of farm land is riskier than a farm that's tucked away from the main road.

- Amount of livestock and crops: The more livestock you own, the greater the risk of an accidental injury.

- Location: The location of your farm will determine the variety of risks it's exposed to. Farms located in areas prone to hazardous weather events or increased crime will be more expensive to insure.

- Revenue: The amount of money you make from your farm will impact your rates.

- Number of employees: Once your farm has employees, you are exposed to more risks.

There are several ways you can lower your insurance rates, including higher deductibles, lower limits, and combining policies. Your New Jersey independent insurance agent can discuss available discounts.

The average farm in New Jersey is 89 acres

Is Farm Land Liability Insurance Necessary in New Jersey?

While not every farm can benefit from farm land liability insurance, if your land includes frontage and you're operating a farm with a variety of livestock, crops, and employees, you want to be protected.

Examples of when a farm land liability policy would be beneficial:

- Your child leaves the fence open on the farm and a cow wanders into the street. The next-door neighbor hits the cow and it breaks their windshield and damages their vehicle. They can sue you for the damage to their car.

- Someone is visiting your farm and petting the goats. A goat steps on their foot and breaks their toe. You can be held liable for the medical bills.

- Your child is having a pool party with friends over and a child slips and falls running by the pool.

- You grow peaches on your farm and sell them to the locals and someone gets sick from your produce.

How Can a New Jersey Independent Insurance Agent Help?

Farm land liability insurance can include a variety of coverages based on the type of farm you run and the assets you need to protect. There's no one-size-fits-all policy, which is why working with a New Jersey independent insurance agent can help.

An agent will talk to you, free of charge, to learn more about your farm land and your home if it's located on your farm. They'll understand what's offered in your homeowners liability policy and what needs to be supplemented with a farm land liability policy. Find a local agent in your area today.

Author | Sara East

Article Reviewed by | Paul Martin

https://www.nj.gov/agriculture/pdf/2019Annual%20ReportFINALwithstats.pdf

https://nj.gov/agriculture/about.htm#:~:text=Virtually%20all%20of%20New%20Jersey's,average%20value%20in%20the%20nation.

© 2025, Consumer Agent Portal, LLC. All rights reserved.