New Jersey business owners who offer professional services or advice to others are at risk of making mistakes. If you provide inaccurate services or faulty information to a client, you could be sued for professional liability. That's why it's important to have the proper business insurance in place.

Errors and omissions insurance can help with these claims, but it's not included in your standard business insurance policy. If you need it, a New Jersey independent insurance agent can help you find an error and omissions policy that protects you. Here's why you should consider this important coverage.

What Is Errors and Omissions Insurance?

Errors and omissions insurance, also referred to as professional liability insurance, is a type of business insurance that helps pay for a liability claim if you're sued for making a mistake in your professional services.

"If you are practicing a professional service it requires special insurance," said insurance expert Paul Martin. "It's crafted to the profession. There's medical, legal, accounting, engineering, architecture, and many more. Each profession has its own niche."

How Much Does Errors and Omissions Insurance Cost in New Jersey?

Any business can make a mistake, but some mistakes are more costly than others. Errors and omissions insurance prices are based on a number of factors.

- Type of business: A doctor is likely to pay higher premiums than a beauty salon.

- Business size: The larger your business, the more likely you are to have an error and omissions claim.

- Claims history: If your business has a history of professional liability claims, then an insurance company assumes it will happen again. This makes you a greater risk and increases premium costs.

- Revenue on the business or agency: The more successful your business, the more you can be sued for. Higher value companies will pay an increase in premium prices.

- Deductible: Choosing a higher deductible tends to result in lower premium costs.

"Errors and omissions policies can cost several hundred dollars or several thousand dollars," said Martin. "It all depends on the type of business and your inherent risks."

What Does Errors and Omissions Insurance Cover in New Jersey?

If you are sued for committing a wrongful act, such as negligence or providing inaccurate or faulty advice, errors and omissions insurance will help pay for the costs associated with the claim.

Errors and omissions will cover the following types of claims:

- Mistakes you make

- Providing faulty or inaccurate advice

- Not delivering a service that was paid for

- Breach of contract

- Missing a deadline

- Failing to meet professional standards and negligence

Errors and omissions will cover the following fees related to a claim:

- Attorney fees

- Court costs

- Administrative costs

- Restitution and settlement costs

- Damages if you're found guilty

- Any additional legal expenses related to a court case

If you're unsure whether your errors and omissions insurance will cover a claim, your New Jersey independent insurance can walk through your coverage and answer any questions.

What Doesn't Errors and Omissions Insurance Cover?

Like most insurance policies, your errors and omissions coverage will have some exclusions. "Most exclusions have to do with categories of damages or responses to various laws," says Martin.

In general, punitive damages and exemplary damages will not be covered. The policy may specify exclusions associated with certain federal laws as well.

Additional common exclusions in an errors and omissions policy

- Fines accrued by the professional

- Intentional acts of wrongdoing

- General liability claims

- Employee claims that would fall under workers’ compensation

- If the negligence is covered by another insurance policy

It's important to understand any gaps in your coverage so you're not left exposed. Ask your independent insurance agent to fully review your errors and omissions exclusions with you.

Who Needs Errors and Omissions Insurance in New Jersey?

There are more than 884,000 small businesses that employ 1,800,000 people in New Jersey.

Not every business will benefit from errors and omissions insurance. If customers pay you in order to receive professional or expert advice on a topic, or you provide a professional service, then you need errors and omissions insurance.

The most common types of businesses that need errors and omissions insurance are medical professionals, lawyers, legal professionals, engineers, and architects. However, many other businesses can benefit from the coverage.

- Beauty salons

- Professional coaches

- Real estate agents

- IT professionals

- Teachers

- Security guards

- Consultants

- Financial advisors

This is not an exhaustive list of businesses that can benefit from errors and omissions insurance. If you're unsure whether you need this coverage, your New Jersey independent insurance agent can work with you to determine if you can benefit from it.

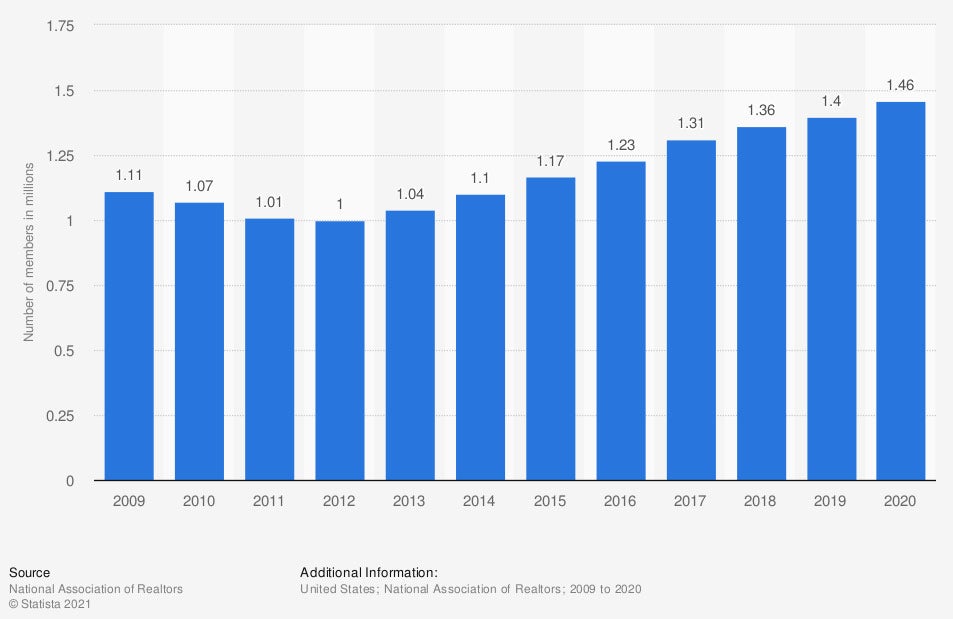

US National Association of Realtors: number of members, 2009-2020

In 2020, the National Association of Realtors had more than 1.4 million members.

Does Umbrella Insurance Cover Errors and Omissions in New Jersey?

In short, no. An umbrella insurance policy will not provide coverage for any claims related to errors and omissions. It will cover libel and slander claims.

Umbrella insurance provides an extra financial layer of coverage in addition to your general liability insurance policy. Your general liability insurance policy will pay for any legal fees associated with third-party personal or property injury up to your policy limit. Once you hit your policy limit, your umbrella insurance kicks in for added coverage.

Any professional errors are excluded from general liability, so are also excluded from umbrella coverage, since it is simply an extension of your existing policy.

How Can a New Jersey Independent Insurance Agent Help?

A mistake can cost a business a lot of money. Even worse, professionals can be sued even after they've retired. Errors and omissions insurance is the only way to protect yourself from a costly lawsuit if something goes wrong.

A New Jersey independent insurance agent is experienced in a variety of business insurance policies. They understand where to shop for errors and omissions insurance and can provide advice about the amount of coverage to purchase. They'll help you find the protection you need, long before you need it.

Article Author | Sara East

Article Reviewed by | Paul Martin

https://www.iii.org/article/should-i-purchase-umbrella-liability-policy-0

https://advocacy.sba.gov/2019/04/24/2019-small-business-profiles-for-the-states-and-territories/

© 2025, Consumer Agent Portal, LLC. All rights reserved.