Like every other aspect of their business, a farmer’s crops need the right protection. From fire to drought and beyond, there are just too many risks that need to be anticipated in advance of the season. Fortunately there’s crop insurance, which is designed to do just that.

Even better, a New Jersey independent insurance agent can help you find the right kind of crop insurance for your farm. They’ll even get you set up with all the coverage you need long before you need to use it. But first, here’s a closer look at this important coverage.

What Does Crop Insurance Cover in New Jersey?

That depends on the specific type of policy you purchase. Your New Jersey crop insurance will vary based on what you and your New Jersey independent insurance agent feel is the best coverage for your unique farm. But boiled down, crop insurance is one important aspect of New Jersey farm insurance that’s meant to guard your crops against many threats, and can include perils like disease outbreaks, storm damage, and more.

What Doesn’t Crop Insurance Cover in New Jersey?

What your crop insurance policy excludes will also depend on the type of coverage you purchase. But some of the most common crop coverage exclusions are:

- Changes in crop values

- Excess moisture

- Drought

- Flood damage

To guard your crops and farm overall against natural flood damage, speak with your New Jersey independent insurance agent about adding a separate flood insurance policy. In a coastal state like New Jersey that can be prone to hurricanes, it’s extra-important to consider this critical coverage — unless you get a policy that we’ll explore further next.

Are There Other Polices That Can Provide Additional Coverage?

Yes, and one of the most comprehensive forms of crop insurance is known as multiple peril crop insurance, which is sold by the Federal Crop Insurance Program. This coverage protects your crops against the biggest possible list of threats, such as:

- Insect damage

- Disease outbreaks

- High wind and hail damage

- Drought

- Fire damage

- Flood and frost damage

One caveat to this coverage: Multi-peril crop insurance has to be purchased before crops are planted, and needs to be renewed every growing season afterwards. Multi-peril crop insurance is the most popular policy among farmers because of its extensive protection. A New Jersey independent insurance agent can help you find the right multi-peril crop coverage for you.

Crop Stats for New Jersey

Before you call up your New Jersey independent insurance agent to get coverage for your crops, it’s helpful to know where the industry stands, not just in your area, but the US overall. Check out some crop stats for the entire country below.

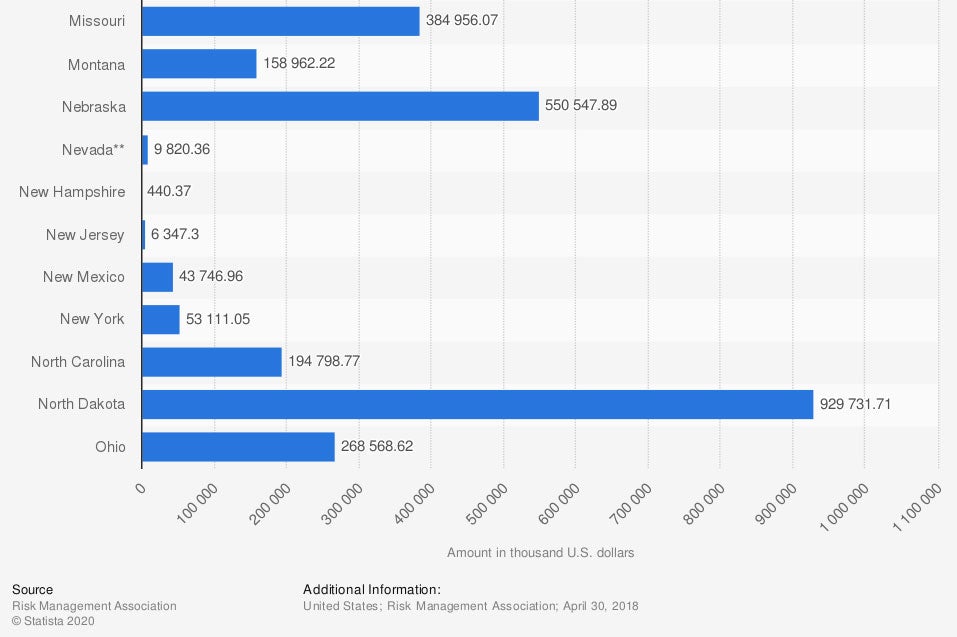

Total value of crop insurance premiums in the United States in 2017, by state

(in thousand US dollars)

In 2017, North Dakota ($929.7 million) and Texas ($970.5 million) had the highest premiums for crop insurance across the country. New Jersey ranked well below them, at a total of $6.35 million.

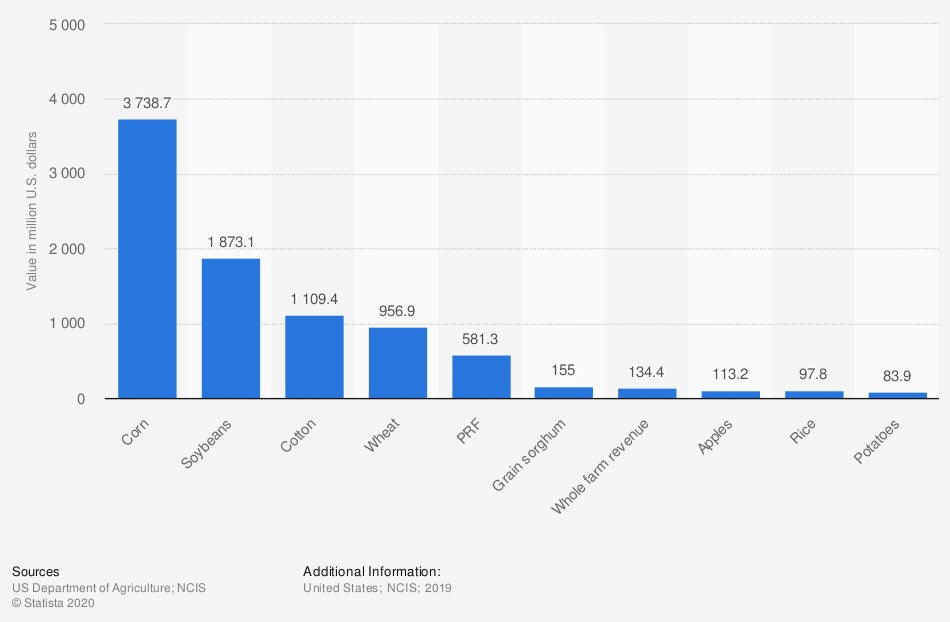

Value of crop insurance premiums in the United States in 2019, by crop

(in million US dollars)

Corn is by far the most valuable crop in the US, and therefore the most commonly insured. Premiums for crop insurance on corn in the year 2019 totaled $3.74 billion. Soybean crops were second, at $1.87 billion, and cotton crops were third, totaling $1.1 billion.

Combining these stats with the recommendations from your New Jersey independent insurance agent, the two of you will work together to assemble the crop insurance policy that makes the most sense for your farm.

Does Crop Insurance Cover Drought in New Jersey?

Depending on the type of coverage you purchase, it can. According to insurance expert Jeffery Green, in order for your crops to be protected against drought, you’ll have to purchase multiple peril crop insurance, which guards against drought and many other disasters. Multi-peril crop insurance provides numerous coverages that are not included in other forms of crop insurance. It’s important to consider this comprehensive policy for your farm.

Do I Need Farm and Ranch Insurance to Be Fully Covered?

If you want all the important coverage your farm needs, it’s important to get a New Jersey farm and ranch insurance policy. Aside from protecting your crops, there are other elements of your farm that need to be covered. Farm and ranch policies provide the following:

- Livestock coverage: Protects your livestock from perils such as disease, storm damage, fire, and more.

- Liability coverage: Protects you against lawsuits filed by third parties for claims of bodily injury or property damage caused by your farm. Coverage reimburses for legal fees, including attorney and court costs.

- Property coverage: Protects your property such as buildings, fences, tools, etc. from disasters like vandalism, fire, theft, etc.

Work with your New Jersey independent insurance agent to get set up with all the coverage you need, including a farm and ranch insurance policy if it’s right for you.

Here’s How a New Jersey Independent Insurance Agent Can Help

When it comes to protecting farmers and their crops against hazards like fire, hail, vandalism, and all other disasters, no one’s better equipped to help than an independent insurance agent. New Jersey independent insurance agents search through multiple carriers to find providers who specialize in every type of crop insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

chart 1 - https://www.statista.com/statistics/649244/total-value-of-crop-insurance-premiums-usa-by-state/

chart 2 - https://www.statista.com/statistics/723049/value-of-crop-insurance-premiums-usa-by-crop/

https://www.iii.org/article/understanding-crop-insurance

© 2025, Consumer Agent Portal, LLC. All rights reserved.