If part of your dream is to own a business, then you're not alone. When you use cars for your daily operations, you'll need the right kind of protection. New Jersey business insurance can have coverage for your commercial autos so that costs for any claims or damage don't have to come out of your own pocket.

A New Jersey independent insurance agent can help you find a policy that suits your needs and budget. They'll do the shopping for you at no cost, making it a no-brainer. Connect with a local expert for custom quotes in no time.

What Is Commercial Auto Insurance?

In New Jersey, business auto insurance provides coverage for a liability or property damage loss involving your commercial vehicles. If you have employees drive company autos, then your risk is even greater, and adequate coverage is necessary.

Is Commercial Auto Insurance Mandatory in New Jersey?

Every driver, commercial or personal, on the road is required to have minimum limits of coverage in New Jersey. Check out the state's mandated car insurance below:

New Jersey's minimum liability requirements for commercial vehicles:

- $15,000 property damage liability per accident

- $30,000 bodily injury liability per accident

- $5,000 bodily injury liability per person

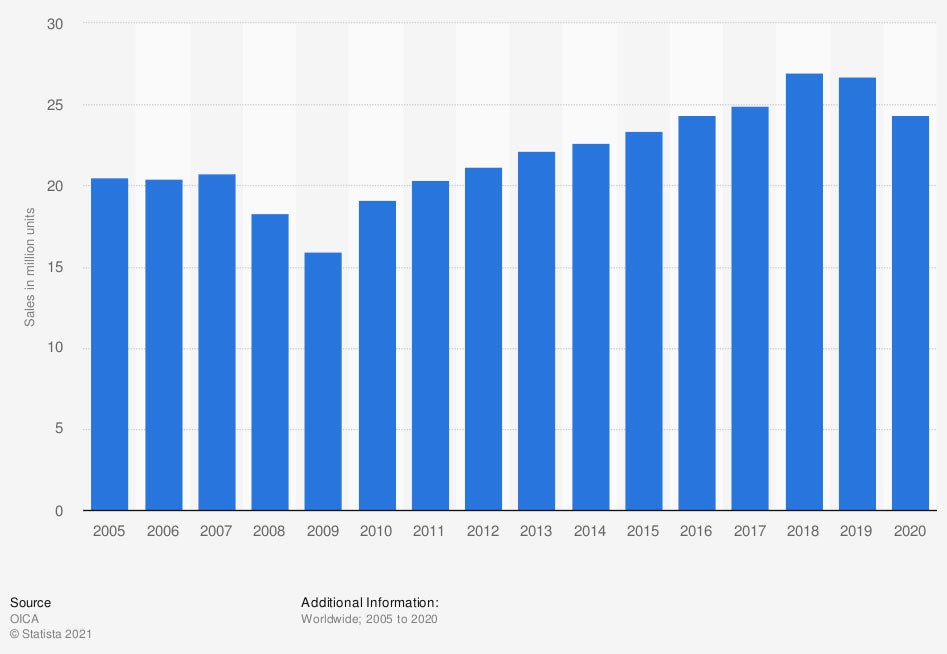

Worldwide commercial vehicle sales (in million units)

When you use commercial autos to run your business, you may want more than the minimum coverage limits.

How Much Does Commercial Auto Insurance Cost in New Jersey?

The cost of your business auto insurance pales in comparison to the price of a substantial loss. Check out the risk factors that carriers use to calculate your New Jersey commercial auto premiums below:

- Year, make, and model of all vehicles

- The radius in which you travel

- The number of drivers and their driving records

- The coverage you choose

- Where you store the vehicles

- What safety measures you have in place

What Does Commercial Auto Insurance Cover in New Jersey?

It's essential to understand what your commercial auto insurance includes and what it doesn't. To avoid taking on any risk yourself, consider reviewing your policy with a trusted agent. Check out the optional coverage choices in New Jersey:

- Towing and roadside assistance: This will pay for a tow to pick up your disabled commercial auto.

- Rental car insurance: This covers the cost of renting a commercial vehicle while your company-owned auto is being repaired.

- Uninsured motorist insurance: If your commercial auto is involved in an accident with an uninsured driver, this provides coverage for property damage and medical costs.

- Comprehensive insurance: This covers the cost to repair or replace your commercial vehicle if it is lost or damaged due to a non-collision accident.

- Collision insurance: This will replace or repair your commercial auto that is damaged due to an accident.

- Hired and non-owned auto liability insurance: If an employee or contractor uses a non-company-owned vehicle while doing business on your behalf, this will cover your exposure.

What Doesn't Commercial Auto Insurance Cover in New Jersey?

Every policy comes with a list of items it won't cover. Your New Jersey commercial auto insurance is no different. Take a look at exclusions that your business auto insurance has:

- Non-scheduled vehicles: Unless your policy has bailee's coverage, you will not have insurance for customer vehicles not listed on the policy.

- Drive other car: If you are renting or driving another vehicle on company time and have an accident, you won't have coverage under your policy without the drive other car endorsement.

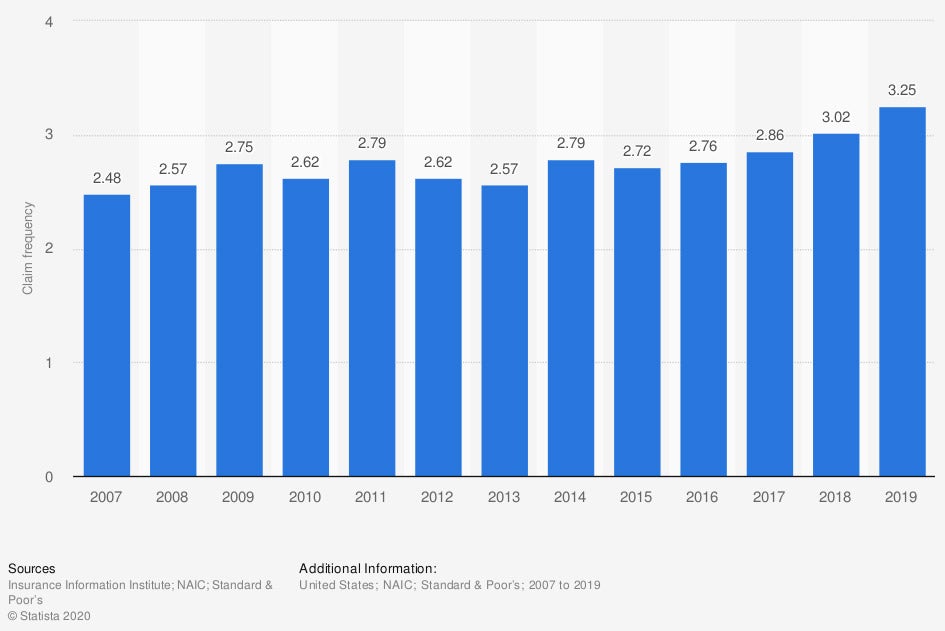

Frequency of private passenger comprehensive auto insurance claims for physical damage in the US

If you're not properly insured, then you could be on the hook for a significant loss. The best way to ensure that you have accurate coverages on your business auto insurance is by checking it for gaps.

How a New Jersey Independent Insurance Agent Can Help You

Commercial auto insurance is a big deal and should be taken with the utmost care. When you're not a licensed professional, coverage can be confusing. Fortunately, a trusted adviser can help you review your policies for free.

A New Jersey independent insurance agent does the shopping through their network of A-rated carriers, so you don't have to. Then, they'll present your business with the best options for coverage and price. Connect with a local expert on TrustedChoice.com to get started today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/265902/worldwide-commercial-vehicle-sales/

Graphic #2: https://www.statista.com/statistics/830114/comprehensive-car-claim-frequency-physical-damage-usa/

http://www.city-data.com/city/New-Jersey.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.