Barbershops aim to please their customers, but unfortunately disasters can and do sometimes happen. Your customers as well as your business need to be protected against all unforeseen threats. That means having the right barbershop insurance in place.

Luckily a New Jersey independent insurance agent can help you find the right kind of barbershop insurance for your business. They’ll even get you equipped with the proper coverage long before you need to file a claim. But first, here’s a deep dive into this important coverage.

What Is Barbershop Insurance?

Barbershop insurance is essentially a special form of New Jersey business insurance customized to meet the needs of barbershops. Risks such as lost revenue and property damage are accounted for in coverage. Common threats to barbershops, like fire and vandalism, are often included. With the help of a New Jersey independent insurance agent, you can find the barbershop insurance policy that works best for you.

What Does Barbershop Insurance Cover in New Jersey?

Depending on your unique barbershop and its needs, your policy might vary, but often barbershop insurance comes with the following coverages:

- Product recall coverage: Provides reimbursement if a bad batch of products gets recalled. Coverage might also include public relations fees to help protect your business’s reputation after an incident.

- Business income: Provides a continuation of income and employee wages if your business must temporarily be shut down due to a covered disaster, like a fire or storm.

- Property damage: Provides reimbursement for damage to your physical building against common perils like wind and hail, fire, vandalism, etc.

- Workers' compensation: Provides protection for your team in case anyone gets injured, becomes ill, or dies on the job. Whether or not your shop has enough employees to be legally required to have coverage, workers’ comp is a critical insurance to consider.

A New Jersey independent insurance agent can further explain common coverages found in many barbershop insurance policies.

Do I Need any Specific Liability Coverages?

A barbershop does require a few different types of liability coverage to be protected. According to insurance expert Jeffery Green, these are some of the most common liability coverages needed by barbershops in New Jersey:

- Product liability: Protects your barbershop against lawsuits resulting from injury or damage to the public caused by the products you sell, like shampoos, soaps, and dyes.

- Professional liability: Protects your shop if you or one of your employees botches a job for a customer who files a lawsuit.

- General liability: Protects your shop from legal and court fees if you get sued for claims of bodily injury or property damage to a third party.

- Cyber liability: Protects your barbershop in case its computer system gets compromised and sensitive data records are stolen or exposed.

A New Jersey independent insurance agent can help you get set up with all the liability protection your barbershop needs.

Barbershop Stats for the US

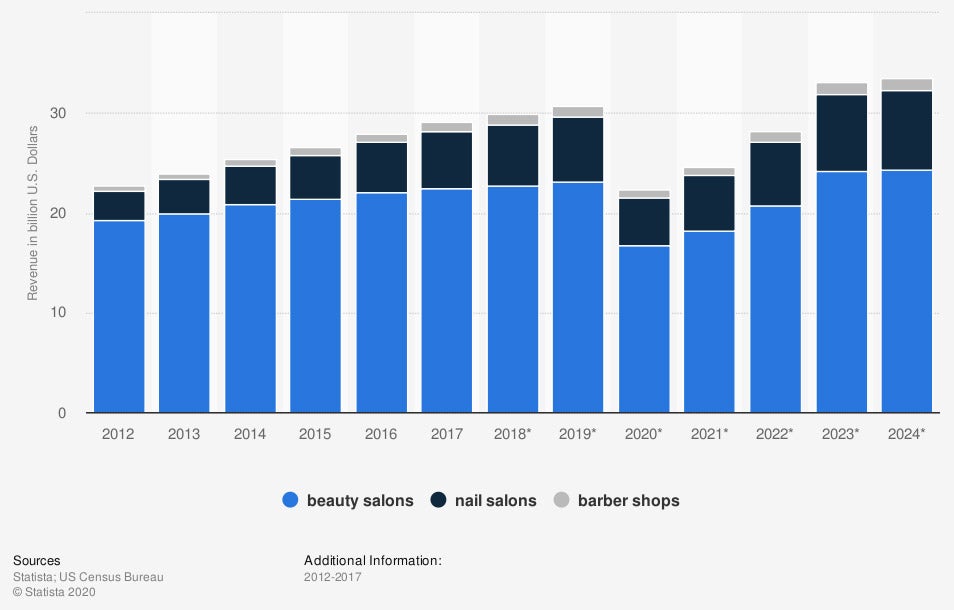

Before you hunt for the right barbershop insurance, it’s helpful to know where your industry stands overall. Check out this chart and see for yourself.

Industry revenue of “hair care and esthetic services” in the US, 2012-2024 (in billion US dollars)

Revenue in the hair and barbershop industry has been steadily increasing over the past decade, but there has been a noticeable dip during the pandemic of 2020-2021. In 2012, beauty salon industry revenue totaled $19.26 billion, while barbershops totaled $0.54 billion. By 2024, however, the beauty salon industry is projected to bring in $24.37 billion in revenue, and barbershops are projected to generate $1.27 billion, more than double their reported income from just a decade ago.

Since the barbershop industry continues to be increasingly profitable, it’s all the more important to get your business equipped with the proper protection to keep it safe for years to come.

How Much Is Barbershop Insurance in New Jersey?

While the cost of your specific policy will vary, you can get an idea of this number by considering the following factors:

- Your exact location

- Your annual revenue

- The size of your business

- The risk level of your business

Insurance for barbershops in New Jersey averages about $240 per month, or $2,900 per year. But if you run a smaller shop, you might only pay $50 per month. If you have a large, very busy barbershop, however, you might pay as much as $1,000 monthly.

Will My Location Impact My Barbershop Insurance Rates?

Your location absolutely influences the cost of your barbershop insurance premiums. If your barbershop is located along the New Jersey coast, you might pay up to 15% more for coverage than your inland counterparts, according to insurance expert Paul Martin. Big cities also tend to have heftier coverage rates. A New Jersey independent insurance agent can help provide exact barbershop insurance quotes for your area.

Here’s How a New Jersey Independent Insurance Agent Can Help

When it comes to protecting barbershop owners against liability risks, property damage, and all other disasters, no one’s better equipped to help than an independent insurance agent. New Jersey independent insurance agents search through multiple carriers to find providers who specialize in barbershop insurance, deliver quotes from several sources, and help you walk through them all to find the best blend of coverage and cost.

chart - https://www.statista.com/forecasts/1014390/hair-care-and-esthetic-services-revenue-in-the-us

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/specific-coverages/property-insurance

https://www.iii.org/article/product-liability-recall-and-contamination-insurance

© 2025, Consumer Agent Portal, LLC. All rights reserved.