New Jersey auto repair shops are responsible for their own property and assets as well as that of the their customers. This presents special risks that need to be covered by auto repair shop business insurance.

With unique risks to cover, a New Jersey independent insurance agent is the best place to start. They'll assist you in getting the proper coverage for your shop at a price that won't break the bank. Here's what makes auto repair shop insurance unique.

What Is Auto Repair Shop Insurance?

Auto repair shop insurance is a type of business insurance that protects your shop and the vehicles you are repairing. It typically includes liability, property, garage keepers, and auto insurance coverage, with the option for additions based on your needs.

"Auto repair shops need coverage for operations, damage to customers' cars while in the garage as well, injuries that can occur on the premises and coverage when cars are being tested or moved," explained Jeffrey Green, independent insurance agent.

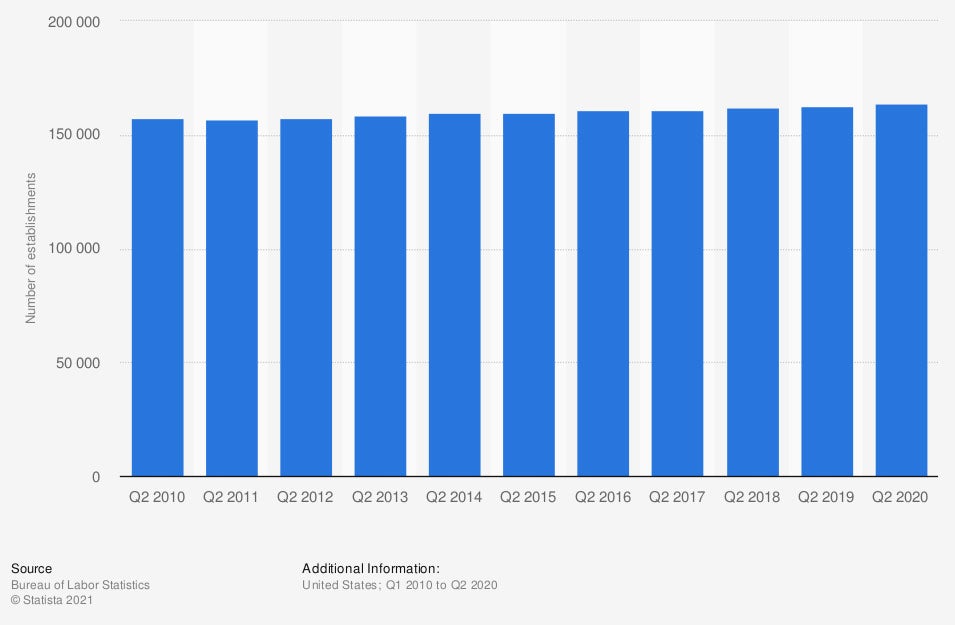

Number of auto repair shops in the US

The number of auto repair shops has increased year over year for the last ten years. In the second quarter of 2020, there were 164,090 auto repair shops in the US.

How to Insure an Auto Shop in New Jersey

Auto shops need comprehensive insurance to protect themselves from a variety of risks. Working with your New Jersey independent insurance agent, you'll discuss your operations, business value, and potential risks to pull together a blend of coverages that have you completely protected.

Most auto repair shops need the following insurance policies:

- General liability: Pays legal fees and medical bills associated with lawsuits for claims of third-party bodily injury or property damage.

- Garage liability: Pays for the operations of the garage for injury and property damage, separately from the business liability coverage.

- Commercial property: Pays for any damage done to the auto shop structures, equipment, or inventory as a result of fire, wind, and other hazards.

- Garage keepers liability: Pays for any damage that involves a customer's car while it's in your care.

- Commercial auto insurance: Pays for customer cars that are being test-driven or moved.

- Workers' compensation: Pays for lost wages and medical needs if an employee is injured or falls ill while on the job.

- Specialty insurance coverage: Additional coverage that you can get depending on the products your shop works on. Examples include tow truck insurance, muffler shop insurance, radiator service insurance, and transmission repair insurance.

Once you've discussed all of your insurance options, your insurance agent will shop policies from multiple providers and present you with coverage options to choose from.

What Does Auto Repair Shop Insurance Cover In New Jersey?

Auto repair shops are responsible for not only fixing cars, but also keeping those cars safe while on their property. In addition, employee and customer safety is a top priority. However, accidents can occur.

The following business risks are covered through auto repair shop insurance:

- On-site slip and falls or other third-party injuries

- Damage to client vehicles while being worked on or moved around the lot

- Employee injury

- Property damage due to fire, wind, theft, vandalism, or other covered hazards

- Commercial vehicles that are being used for the business

- Employee theft or lawsuits

- Lost wages and other bills due to temporary business closure

A New Jersey independent insurance agent can help you understand the full range of coverages that are provided through your auto repair shop policy. They can also assist in filling any gaps in your coverage.

The Benefits of Auto Repair Shop Insurance in New Jersey

More than 884,000 small businesses currently call New Jersey home. While not all of these are auto repair shops, any business is susceptible to accidents. Without the proper insurance, an extreme event or lawsuit can bankrupt your shop.

For auto repair shops, you need to consider the protection of your property and personal assets, your employees and customers, and the vehicles that you're being trusted with.

Business insurance is the only way to fully protect all of these important things. It helps pay for damage and financial losses so you don't have to.

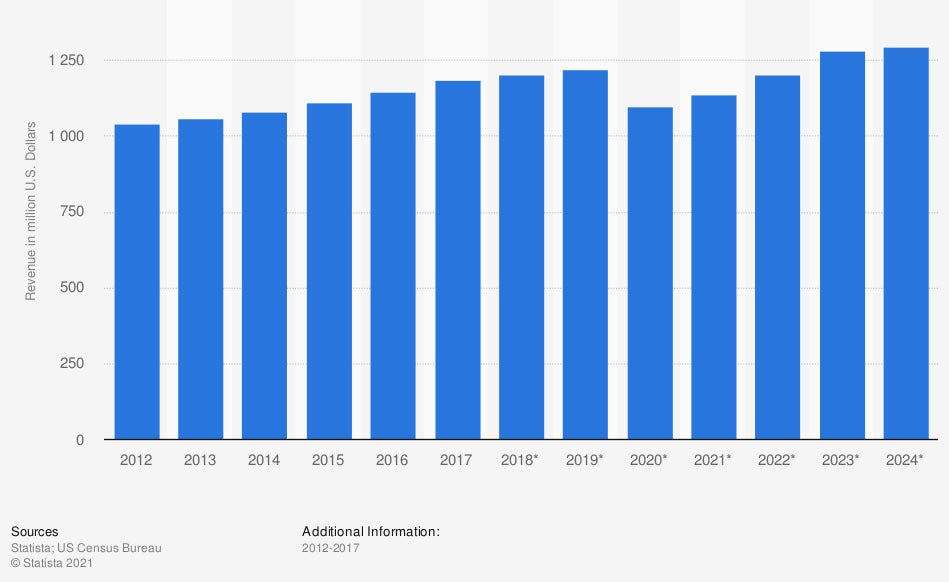

Industry revenue of “automotive body, paint and interior repair” in New Jersey (in million US dollars)

Auto repair shops are expected to continue to grow in New Jersey. By 2024, it's projected that the revenue of automotive body, paint, and interior repair and maintenance in New Jersey will amount to approximately $1.2 million.

How Much Does Auto Repair Shop Insurance Cost in New Jersey?

Your New Jersey auto repair shop insurance rates will be based on the individual risks that your shop faces. Businesses are in danger from different elements depending on where in the state they're located.

Every auto shop will have different needs, but the most common factors that contribute to calculating premiums include:

- Whether you're located inland or on the coast

- How close your shop is to a fire station

- Crime and theft rates in your area

- Claim history

- Size of shop

- Type of vehicles you repair

- Value of your business and assets

- Local weather dangers

The more risks your auto repair shop has, the higher your insurance premium will be. However, smaller auto shops can save money by purchasing a New Jersey business owners policy, which your independent insurance agent can tell you more about.

How Can a New Jersey Independent Insurance Agent Help?

While New Jersey business insurance is fairly standard, auto repair shops need more than your average coverage. Without it, you'll be left exposed to risks that could bring your entire shop down.

New Jersey independent insurance agents are here to talk with you, free of charge. They'll go over every aspect of your auto repair shop and recommend different coverages. They'll shop insurance quotes and advise you on the best carriers to purchase from.

Author | Sara East

Article Reviewed by | Jeffery Green

https://advocacy.sba.gov/2019/04/24/2019-small-business-profiles-for-the-states-and-territories/

Graphic 1: https://www.statista.com/statistics/436416/number-of-auto-repair-and-maintenance-shops-in-us/

Graphic 2: https://www.statista.com/forecasts/1211124/automotive-body-paint-and-interior-repair-revenue-in-new-jersey

© 2025, Consumer Agent Portal, LLC. All rights reserved.