When you use a motorized vehicle to get around town, there are rules of the road. Part of those requirements is driving with the proper protection. New Jersey car insurance rates can be lowered when you have a trusted adviser on your side.

A New Jersey independent insurance agent has access to multiple carriers at once so that you have options on policy and price. They even do the shopping for free, saving you more money. Connect with a local expert to get started.

What Is Car Insurance?

In New Jersey, you'll be required to carry the minimum liability limits to use the road. Check out what's necessary below and how car insurance works:

- Minimum limits of auto liability in New Jersey: $15,000 per person/ $30,000 per accident/ $5,000 property damage

- Property: Coverage for damage to vehicles and outside property

- Liability: Coverage for bodily injury or property damage

- Medical: Coverage for your medical expenses due to an at-fault loss

How Much Is Car Insurance in New Jersey?

Insurance pricing will vary from person to person. There are many factors involved when determining your premiums. The average price of car insurance in New Jersey is $1,595 per year. Insurance companies look at the following items when calculating your costs:

- Loss history

- Driving record

- Value of vehicle

- Location

- Experience level and age

- Coverage selection

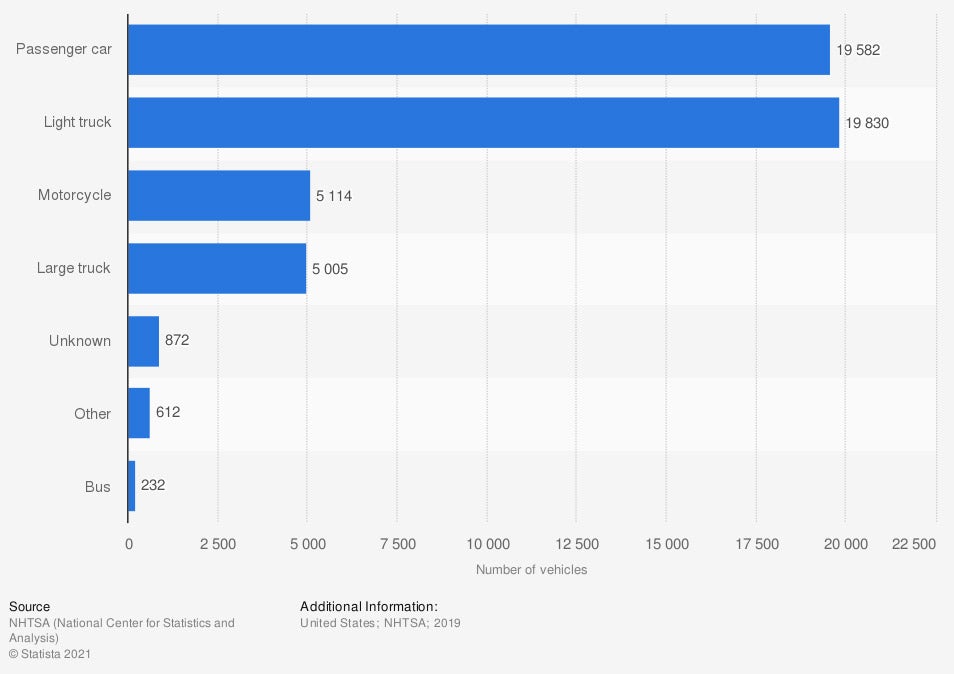

Number of vehicles involved in fatal traffic crashes in the US

Car accidents can occur without a moment's notice. That's why having the right limits in place beforehand is critical.

How Much Is Full Coverage Car Insurance in New Jersey?

The national annual average cost of car insurance is $1,311. While you can't know your exact rates for different limits without quotes, you can have an idea. Full coverage car insurance is typically double the price of liability-only insurance.

Check out your full coverage car insurance options:

- Gap coverage: Pays for the difference between your remaining loan balance and the market value when a total loss occurs.

- Tow coverage: Will pay for a tow truck to tow a covered auto due to a loss.

- Rental car coverage: Will provide reimbursement for a rental car when your covered auto is damaged.

- Comprehensive coverage: Will pay for property damage to your vehicle that is hit by an unavoidable obstruction.

- Collision coverage: Pays for property damage to your car in the event of a crash.

Will My Safe Driving Record Impact My Car Insurance Rates in New Jersey?

In any state, your driving record will have a major impact on your car insurance rates. In New Jersey, this will include violations, tickets, DUIs, and at-fault accidents.

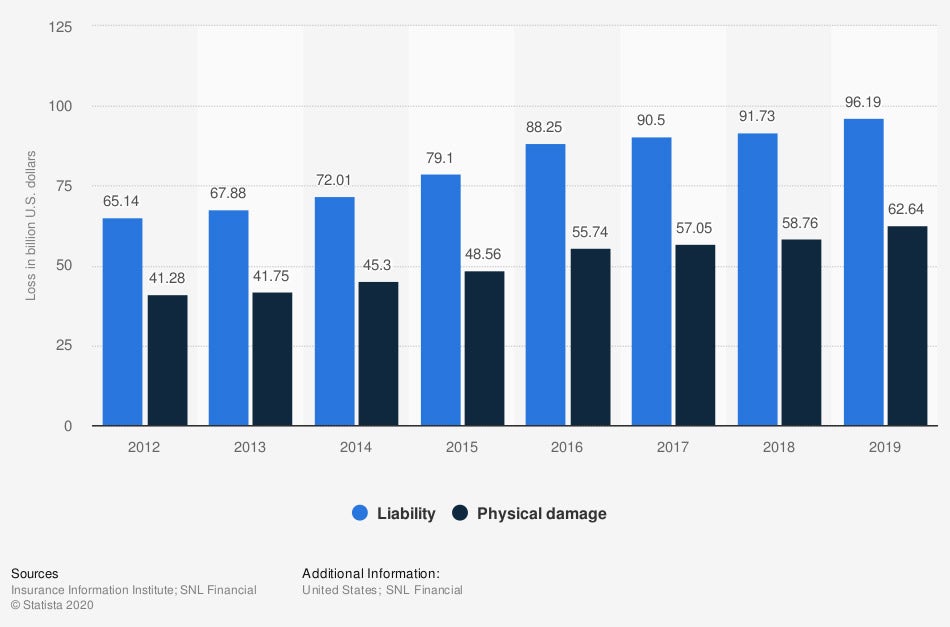

Incurred losses for private passenger auto insurance in the US, by state

When you get into a car accident, it can be costly. If you're unprepared with low insurance limits, you could be paying for the expense on your own.

How a New Jersey Independent Insurance Agent Can Help

New Jersey car insurance should protect you from all the what-ifs. When you're shopping for coverage, price is a factor that has to be taken into consideration. Fortunately, you're not alone in your search.

A New Jersey independent insurance agent has a network of carriers to get options on policy and premium. They'll ensure that you have the best rates in town by reviewing and comparing your coverage with highly rated markets. Connect with a local expert on trustedchoice.com for tailored quotes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/192098/number-of-vehicles-involved-in-fatal-traffic-crashes-in-the-us/

https://www.statista.com/statistics/428991/incurred-losses-for-private-auto-insurance-usa-by-type/

http://www.city-data.com/city/New-Jersey.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.