Life insurance can be used to leave financial support for loved ones in the event of your death. Whether you're someone's beneficiary or you're setting up a life insurance plan for your family, it's important to know if and when life insurance is taxable.

A New Jersey independent insurance agent can answer this question and more about life insurance. Some parts of life insurance are taxable. Here's what you should know.

Is New Jersey Life Insurance Taxable?

As an owner of a life insurance policy, you pay monthly premiums in order for a beneficiary to receive a lump-sum payout when you die. These are referred to as death benefits. "The monthly premiums that you pay towards your policy are not tax-deductible," explained insurance expert Jeffrey Green.

According to Green, death benefits are not taxable so beneficiaries do not need to worry about being taxed on the amount of money they receive when you die.

New Jersey life insurance facts

- Life expectancy: 80

- Total life insurance purchases: $121 billion

- Payments to life insurance beneficiaries: $3.8 billion

- Payments to group life insurance beneficiaries: $1.2 billion

Is Whole Life Insurance Taxable in New Jersey?

Whole life insurance is considered a permanent life insurance plan. Permanent plans are designed to cover you for your entire life, but also come with a savings account that can accrue money.

While you are alive you can choose to borrow against or withdraw money from the savings component of the account. "If you start taking money out of life insurance on a permanent plan, any withdrawals are tax-free up to the basis, which is how much you put into it," explained Green.

If you borrowed against the remaining values you would not pay taxes on them. However, if you completely withdrew the money from the account, then you would begin to pay taxes on it.

Permanent life insurance savings accounts can also earn interest. Green explained that you will not pay taxes on the interest earned until you withdraw beyond what you put into the account.

Is Term Life Insurance Taxable in New Jersey?

Term life insurance is not taxable. The death benefits are not taxable to the beneficiary and premiums paid by the policyholder are not tax-deductible.

When purchasing term life insurance you'll choose a specific amount of time, typically 10, 20, or 30 years to receive coverage. Should you pass away within this time frame then your beneficiary would receive a payout.

Is Business Life Insurance Taxable in New Jersey?

If an employer is offering their employees life insurance, there is a chance that the premiums can be tax-deductible to the employer. This occurs on group term insurance where premiums are paid for by the employer. The employer can deduct whatever amount they are contributing.

There is also a chance that the employee can be taxed. Employees start to pay tax on employer-offered life insurance when the coverage is above $50,000.

"Business life insurance is otherwise not taxable," said Green. "Premiums for policies like key person insurance are not tax-deductible. The death benefits are tax-free but the premiums are still not tax-deductible."

Can an Annuity Be Taxed?

In short, yes, annuities can be and are taxed.

Annuities are an insurance product that is designed for retirement. Unlike a life insurance policy, which is typically purchased for your loved ones when you die, an annuity is designed to produce a guaranteed lifetime income for yourself.

How do annuity taxes work?

- As the values accumulate in the annuity, they're tax-deferred. This means no taxes are paid until the money is taken out

- As the money is taken out the earnings come out first and then your basis comes out. If you purchased a deferred annuity for $100,000 and now it's worth $200,000, withdrawals will be taxable up to $100,000. "Opposite to life insurance, the taxable money comes out first with an annuity," said Green.

- Annuities are taxed at ordinary rates

There are different ways that an annuity can be taxed so it's best to speak with your New Jersey independent insurance agent if you have or want to purchase an annuity.

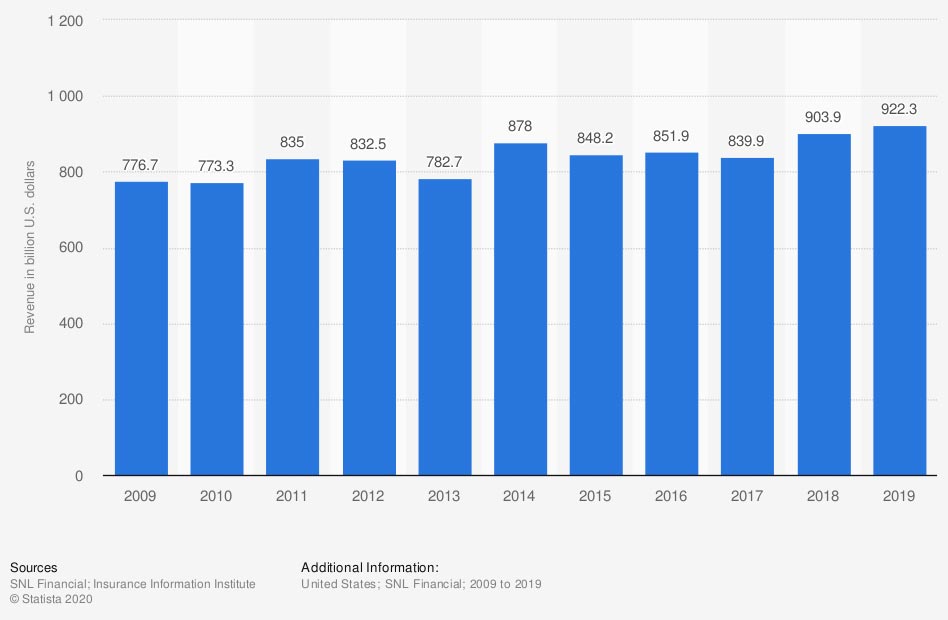

Total revenue of life/annuity insurance industry in the US

In one recent year, the US life/annuity insurance industry generated revenues of $922.3 billion.

How a New Jersey Independent Insurance Agent Can Help You

New Jersey independent insurance agents are experts in all things life insurance. They know which carriers are known for providing good policies and are easy to work with should you have a situation arise.

Agents will talk with you, free of charge, to learn about your goals and needs with life insurance. They can help you understand any potential tax implications with your policy and shop for affordable New Jersey life insurance coverage.

Author | Sara East

Article Reviewed by | Jeffery Green

https://www.irs.gov/faqs/interest-dividends-other-types-of-income/life-insurance-disability-insurance-proceeds#:~:text=Answer%3A,report%20it%20as%20interest%20received

https://www.annuity.org/annuities/taxation

https://www.statista.com/statistics/374992/life-insurance-purchases-in-the-us-by-states/

https://www.statista.com/statistics/194426/total-us-life-insurance-payments-to-beneficiaries-by-state/

https://www.statista.com/statistics/194406/us-group-life-insurance-payments-to-beneficiaries-by-state/

© 2025, Consumer Agent Portal, LLC. All rights reserved.