Your home might be where you spend the vast majority of your time, and you rightfully want to feel safe there. The best way to ensure that your home stays protected, even in case of disaster, is with the right home insurance policy. Luckily many home insurance policies are affordable.

A New Jersey independent insurance agent can help you find the best coverage for your needs, and also inform you of what all influences its cost. They can provide you with the cheapest rates for your area. But first, here’s a closer look at how much home insurance costs.

Average Cost of Homeowners Insurance

The good news is that homeowners insurance in New Jersey is, on average, cheaper than the US average for coverage. Knowing the average cost of home insurance in your town is a good first step before shopping for coverage.

Here’s how New Jersey homeowners insurance rates stack up against the US average:

- Home insurance in the US costs $1,211 annually.

- Home insurance in New Jersey costs $1,192 annually.

- New Jersey ranks 23rd out of all states for the most expensive home insurance rates.

- New Jersey residents pay about $228 less annually for coverage than the US average.

A New Jersey independent insurance agent can provide you with exact home insurance quotes for your area and help you find a policy that best meets your needs.

How to Calculate Home Insurance in New Jersey

Your greatest ally when it comes to calculating home insurance costs is a New Jersey independent insurance agent. They’re well-versed in all the factors that go into the final premium rates of many types of coverage, including home insurance.

Better yet, New Jersey independent insurance agents can scout out any discounts you might qualify for on your coverage. They’ll get you equipped with the right coverage from an insurance company that offers affordable rates and more.

Home Insurance Cost Factors in New Jersey

Certain aspects of your home insurance premium might be obvious, while others might be less so. According to insurance expert Paul Martin, the following factors tend to weigh heavily in home insurance rates:

- Age of construction: Older homes are considered more of a risk to insure by insurance companies, and often come with more expensive rates because of it.

- Property loss history: The age of your home might not matter quite as much as that property’s loss history. Homes with a long list of claims will often be more expensive to insure than those with a clean history.

- Roof condition: The roof protects the home from all kinds of damage. As a result, home insurance companies consider the condition of your roof as a big factor in your coverage’s premium.

- Home updates: If you’ve got updated wiring, plumbing, AC units, furnaces, etc., you can pretty much expect your home insurance company to reward you with cheaper premium rates.

Your New Jersey independent insurance agent can further explain the many factors that go into determining the price of your home insurance.

Home Insurance Stats

Without home insurance, you’re vulnerable to all kinds of disasters that could strike and leave you with a large financial loss. These stats of how much home insurance companies paid out to their policyholders in recent years helps paint a clearer picture of the importance of coverage.

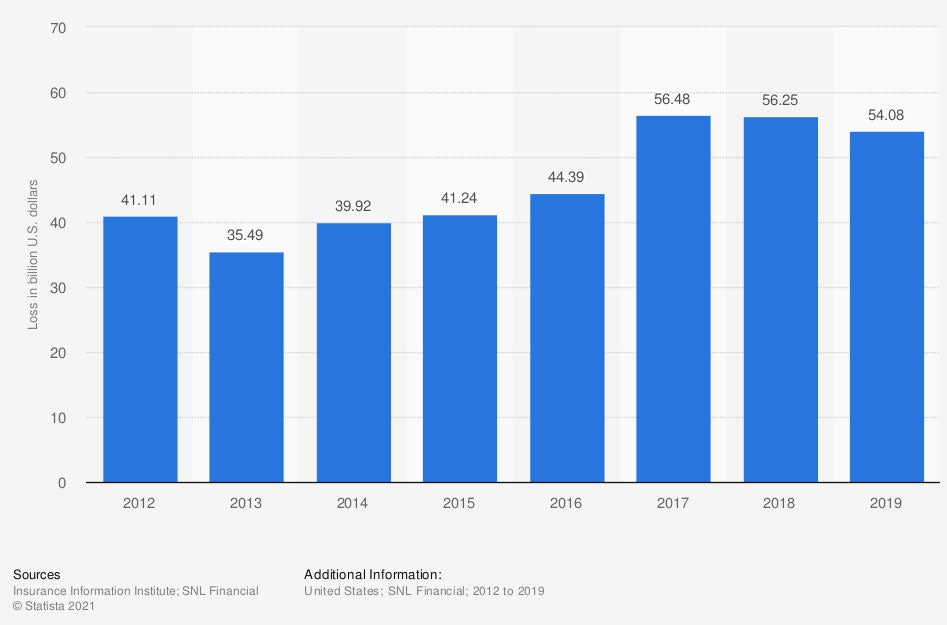

Incurred losses for homeowners insurance in the US

Homeowners insurance losses amounted to $41.11 billion in the first year of the observed period. This amount jumped up quite a bit, to $54.08 billion, at the end of the observed period.

Home insurance is not only important to have from a cautious standpoint, but also because you’re highly likely to actually use it over time. A New Jersey independent insurance agent can help you get your home covered today.

What Does Home Insurance Cover in New Jersey?

Standard home insurance policies in New Jersey provide a handful of critical coverages. You may add on extra coverages to your policy, but these are some of the core protections you can expect to find:

- Contents or property coverage: Your belongings in the home (and sometimes external storage units), like clothes, furniture, etc., are protected against many threats like lightning, theft, and more.

- Structure or dwelling coverage: The actual physical structure of your home is protected against wind and hail damage and much more, as well.

- Liability coverage: Home insurance also provides important coverage against lawsuits filed against you by third parties.

- Additional living expenses: If a devastating storm or other disaster forces you to live somewhere else while your home is being repaired, your home insurance covers these additional expenses.

A New Jersey independent insurance agent can help you review your home insurance policy and become familiar with all the coverages it provides.

What Doesn’t Home Insurance Cover in New Jersey?

Home insurance covers you and your home in many ways. Your policy can’t cover just anything, however. According to Martin, these are some of the things most commonly excluded in standard home insurance policies:

- Routine maintenance

- Home-based business liabilities

- Flood or earthquake damage

- Certain explosions

- Damage from nuclear fallout and war

- Insect damage and infestations

Your New Jersey independent insurance agent may be able to help you add more coverage to your home insurance policy, if necessary.

Here’s How a New Jersey Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect homeowners against commonly faced liabilities. New Jersey independent insurance agents shop multiple carriers to find providers who specialize in home insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

https://www.statista.com/statistics/428998/incurred-losses-for-homeowners-insurance-usa/

https://www.iii.org/article/homeowners-insurance-basics

https://www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insurance

© 2025, Consumer Agent Portal, LLC. All rights reserved.