Buying a brand new house is a big deal. Unfortunately, your excitement and celebration can be cut short if disaster strikes before the paint's even finished drying. So what happens if, for example, there's an electric fire in your brand new house?

Luckily, a New Jersey independent insurance agent can help you get set up with the right homeowners insurance to protect you against this catastrophe and many others. They'll also help you answer this important question. But before it gets that far, let's start with an overview of who'd be responsible in this case.

Who’s Responsible if There’s an Electric Fire in My New House?

Most likely the fault would lay with the builder of the home or the contractor who installed the electrical wiring. That said, it'd still probably be on you to file a claim through your New Jersey homeowners insurance. Your insurer would then help figure out repairs, reimbursements, and temporary housing if needed.

Fortunately, a standard homeowners insurance policy includes coverage in case of disasters like this one. In fact, fire is one of the main perils covered by home insurance. So even if you're stuck filing a claim shortly after the big move, at least you can rest assured you'll get reimbursed for the property damage.

What Kind of Insurance Protection Does the Builder Likely Have?

The builder or electrical contractor, if they're legitimate, most likely has their own contractors professional liability insurance, which is meant to protect them against errors on the job. If a contractor botches a project that leads to a catastrophe like an electrical fire, their insurance can protect them in case they get sued.

Since the contractor is probably responsible in the case of an electric fire in a brand new house, their professional liability coverage would reimburse them for lawsuit, court, attorney, and settlement fees if the homeowner pressed charges. That's why it's important to ensure that any contractor you hire is equipped with this coverage before you ever sign a contract.

Am I Responsible for Covering Any Damage Caused by the Electric Fire?

It would be your homeowners insurance's responsibility to recoup your losses after an electric fire in your new home. According to insurance expert Paul Martin, the insurer would do this by suing the builder or contractor's business for the loss and securing reimbursement through their insurance policy. However, if the builder or contractor wasn't properly insured, the loss could fall on you.

Assuming the contractor was insured, you'd only be responsible for the deductible before your home insurance covered the rest of the property damage. Your home insurance would pay for the loss up to the limits in your dwelling and contents categories, as well as for temporary housing if necessary through its additional living expenses section. You'd also be protected if anyone at your house got injured in the fire and sued you for it thanks to your liability coverage.

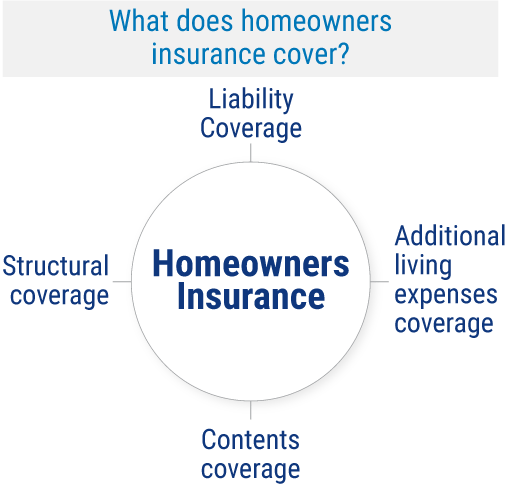

What Does Homeowners Insurance Cover in New Jersey?

Here's a breakdown of how New Jersey homeowners insurance covers you not just in this terrible catastrophe, but in everyday life. Homeowners insurance provides the following major coverages:

- Contents coverage: Your personal belongings like clothing, furniture, silverware, etc. is protected against damage caused by covered perils like theft, fire, etc.

- Structural coverage: Your home's physical structure and foundation are also protected against physical damage by fire, vandalism, etc.

- Liability coverage: You're protected against lawsuits for claims of bodily injury or personal property damage by third parties with liability coverage.

- Additional living expenses coverage: You're also protected against additional costs that could arise if you have to live somewhere else, like a hotel, while waiting for home repairs to be complete after a covered peril like a fire.

So, not only would your home insurance protect your physical property after an electric fire at your brand new place, but it would also protect you if any of your guests got injured, and by providing a temporary residence if needed. That's why it's critical to work with a New Jersey independent insurance agent to get coverage in case of unexpected incidents like this one.

What Doesn't Homeowners Insurance Cover in New Jersey?

Your New Jersey homeowners insurance may protect you in many important ways, including against electric fires in a brand new home, but it can't protect against everything. Here are some examples of non-covered perils by your home insurance:

- Insect infestations: If your home gets damaged by insects, your home insurance won't cover it.

- Flood or earthquake damage: Home insurance doesn't cover property damage or other losses caused by earthquakes or natural flooding. You'd need separate flood insurance or earthquake insurance for that.

- Business losses: If you run a business out of your home, you'll likely need a special home-based business endorsement added to your home insurance to cover commercial property losses, etc.

- War or nuclear damage: These are a couple of extreme perils not covered by home insurance across the map.

- Maintenance costs: It's considered the homeowner's responsibility to maintain the premises, so regular upkeep costs aren't covered by home insurance.

Your New Jersey independent insurance agent can help explain in more detail why these perils aren't covered by your home insurance, and how you can patch holes in your coverage with additional policies or riders.

Will My Rates Be Affected Even though I’m Not Responsible for the Damage?

It can depend on several factors, including your insurance company and their conclusion to any investigation they complete after you file a claim. Though you may be forgiven by your insurance company for a single incident, especially one that wasn't your fault, you could also see premium hikes of about nine percent.

Just one home insurance claim can raise your premiums by an average of 9%.

It's also important to keep in mind that filing subsequent claims can hike your premiums even more. Further, if you file multiple claims of the same type, you can end up getting your coverage canceled or non-renewed by your insurer altogether. That's why it's crucial to try to prevent incidents before they ever happen, as much as possible.

What Can I Do to Prevent Electrical Fires in My Home?

Fortunately, there are a few ways you can proactively prevent electrical fires in your home, regardless of its age.

Prevent electrical fires in your home by doing the following:

- Upgrading your outlets: An electrician can install special appliance-grade outlets in your home that are designed for the exact thing you want to plug into them, to help prevent overloading and fires.

- Use water at a safe distance: Never use water near an electrical outlet as a method of caution against fires.

- Don't overload breakers: Be careful when using a lot of large appliances at once, and upgrade old devices to those with newer wiring and that use less current to operate.

- Don't daisy chain extension cords: Never plug an extension cord into another one, and never plug appliances that use a lot of power into an extension cord.

- Use the proper bulbs: Always read the wattage requirements on your light fixtures before putting in a lightbulb.

- Only hire legitimate contractors: Before hiring a contractor to work on your electrical system or anything else, request to see their references, proof of insurance, and proof of licensing to ensure the job gets done safely.

Following these simple tips can help you prevent electrical fires in your new home before they start. Though poorly installed wiring can be outside of your control, many other types of disasters can be avoided altogether with these safety practices.

Why Choose a New Jersey Independent Insurance Agent?

New Jersey independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut through the jargon and clarify the fine print so you know exactly what you’re getting.

New Jersey independent insurance agents also have access to multiple insurance companies, ultimately finding you the best home insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

https://www.irmi.com/term/insurance-definitions/contractors-professional-liability-insurance

https://www.iii.org/article/what-covered-standard-homeowners-policy

https://money.cnn.com/2014/10/19/real_estate/homeowners-insurance-claims/index.html

https://blog.directenergy.com/how-to-avoid-overloading-circuits-during-holidays/

© 2025, Consumer Agent Portal, LLC. All rights reserved.