If you own a property, it can be rewarding and challenging at the same time. When you are protecting and maintaining a home, a lot goes into it, and the proper coverage is on the list. New Jersey homeowners insurance can help with a variety of losses, including chimney fires.

A New Jersey independent insurance agent will have access to several markets that give you options. They do the shopping for free, making it super-simple. Connect with a local expert for tailored quotes to get started.

What Does Homeowners Insurance Cover in New Jersey?

When a chimney fire occurs in your New Jersey home, it can put you in a state of panic. In order to avoid financial devastation, it's essential to have the foundational home coverages included in most policies.

How your home coverages are broken down:

- Dwelling limit: Pays for the replacement or repair of your home itself when a covered claim occurs.

- Personal property: Pays for the replacement or repair of your personal belongings.

- Personal liability: Pays for bodily injury, property damage, or slander claims against a household member.

- Additional living expenses: Pays for your temporary stay at another property when a claim renders your home unlivable.

- Medical payments: Pays for the first $1,000 - $10,000 of a medical expense when a third party gets injured on your property.

Homeowners insurance covers standard limits that protect against certain losses automatically. Fire, theft, vandalism, severe weather, and water damage are among them.

Can I Purchase Homeowners Insurance after a Chimney Fire in New Jersey?

Your homeowners insurance may go up in premium after a major loss like a chimney fire. However, unless you have more than one claim in a 3 to 5 year period, you'll be able to get coverage with most carriers. Check out what losses could affect your home the most in New Jersey:

- Severe storms and lightning

- Hurricanes and tropical storms

- Flooding and water damage

- Heavy snow

- Burglary and other property crimes

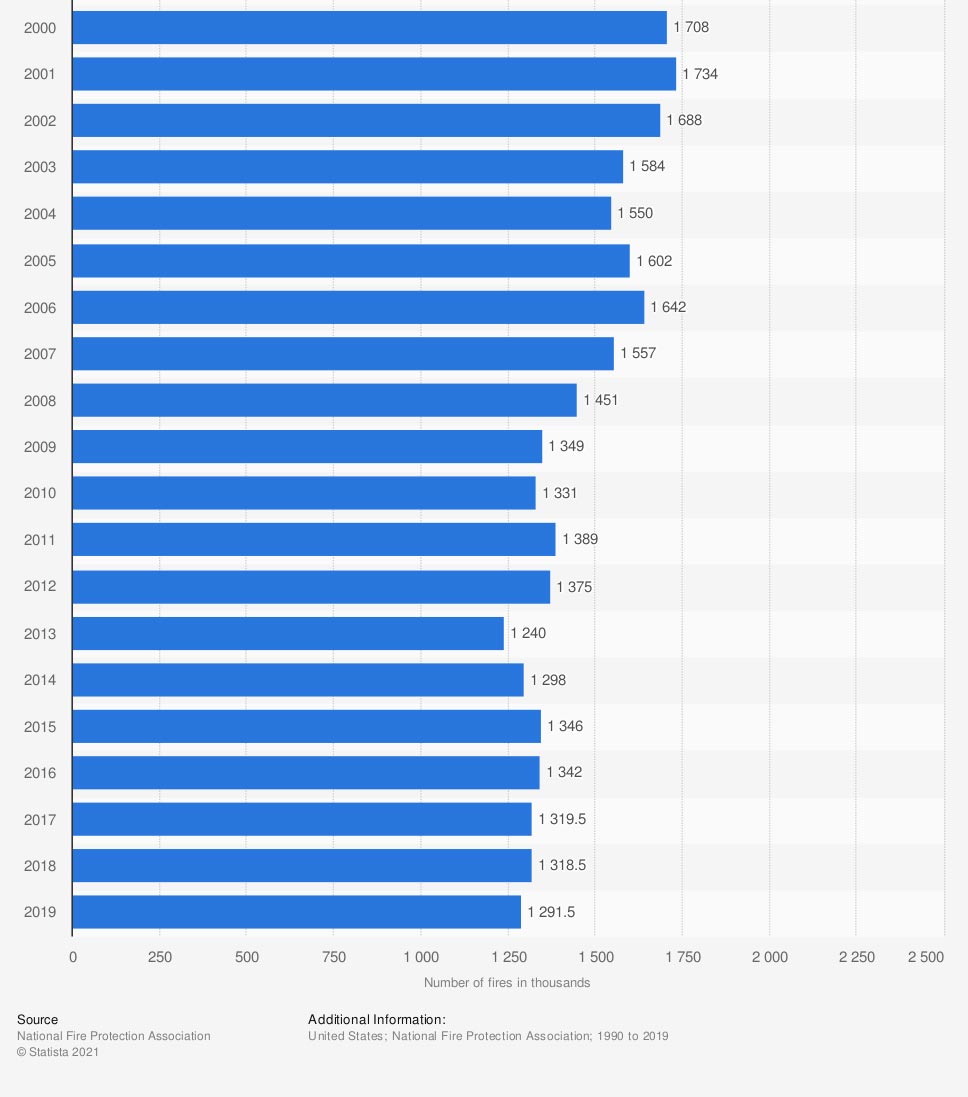

Total number of reported fires in the US

A fire can come on without warning and cause a total loss. To have the best protection in the event of a chimney fire, review your policy for accuracy.

Does New Jersey Home Insurance Protect against Chimney Fires?

A chimney fire can be a scary thing and doesn't come with much warning. When a fire loss is occurring under the surface, it can cause damage fast.

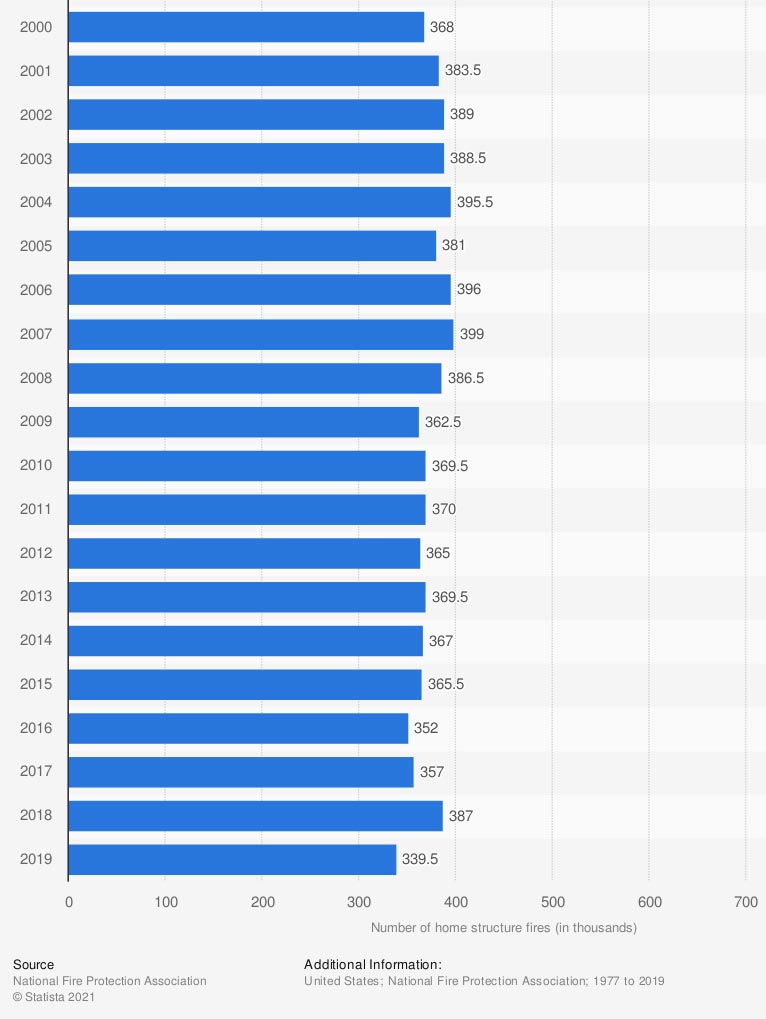

Total number of reported home structure fires in the US

Fortunately, the majority of homeowners policies in New Jersey come with coverage for a chimney fire. When you create a chimney cleaning routine, it will help prevent a future loss.

Will My New Jersey Home Location Impact My Rates?

Where your home is located will affect your insurance costs as well. Carriers look at the crime rate and weather losses when determining your premiums. Check out the average annual cost of home insurance:

- National average home insurance premium: $1,211

- New Jersey average home insurance premium: $1,192

An insurance company will also factor in flood zoning. In New Jersey, you can have a licensed professional look up if you're in a high-risk flood zone for free.

How a New Jersey Independent Insurance Agent Can Help

The correct homeowners insurance can make a huge difference when a chimney fire loss occurs. If you're appropriately insured, then you won't have to worry about paying out of pocket. This could save you from financial ruin and make a bad situation better.

Fortunately, A New Jersey independent insurance agent can help with policy and premium options that are affordable. Since they have a large network of carriers, you'll have options. Connect with a local expert on trustedchoice.com for free today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/203760/total-number-of-reported-fires-in-the-united-states/

https://www.statista.com/statistics/376918/number-of-home-structure-fires-in-the-us/

http://www.city-data.com/city/New-Jersey.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.