Your farm’s livelihood depends on the health and success of its crops. But without the right protection, your crops are vulnerable to all sorts of threats. That’s why having crop insurance is so beneficial.

Fortunately a New Jersey independent insurance agent can get you set up with all the crop insurance you need. They’ll even get you equipped with coverage before you need to use it. But first, here’s a closer look at this critical coverage.

What Is Crop Insurance?

Crop insurance is one aspect of a New Jersey farm insurance policy designed to protect crops from many threats. Crops are prone to disease, storm damage, and much more, and they need to be covered so your farm doesn’t face a huge financial loss. A New Jersey independent insurance agent can help you get equipped with all the crop insurance your farm needs.

What Does Crop Insurance Cover in New Jersey?

There are several different types of crop insurance in New Jersey, and the policy you select will depend on your unique farm’s needs. You might go for a simpler policy such as crop-hail insurance, which is designed to cover only fire and hail damage.

Or you might only be worried about your crop’s contract or harvest value, and select revenue crop insurance. Still, you may need more comprehensive coverage in the form of multi-peril crop insurance. A New Jersey independent insurance agent can help advise on which coverage would work best for you.

What Doesn’t Crop Insurance Cover in New Jersey?

The exclusions in your crop insurance policy will of course depend on which type of coverage you choose. However, most crop policies come with the following exclusions:

- Damage from negligence

- Intentional or malicious acts

- Nuclear fallout

- War damage

To get the most coverage for your crops, you should consider getting a multi-peril crop insurance policy.

The Most Expensive Crops to Insure

When hunting for crop insurance with your New Jersey independent insurance agent, it’s helpful to know which crops will cost the most to insure. Check out some recent crop insurance stats below.

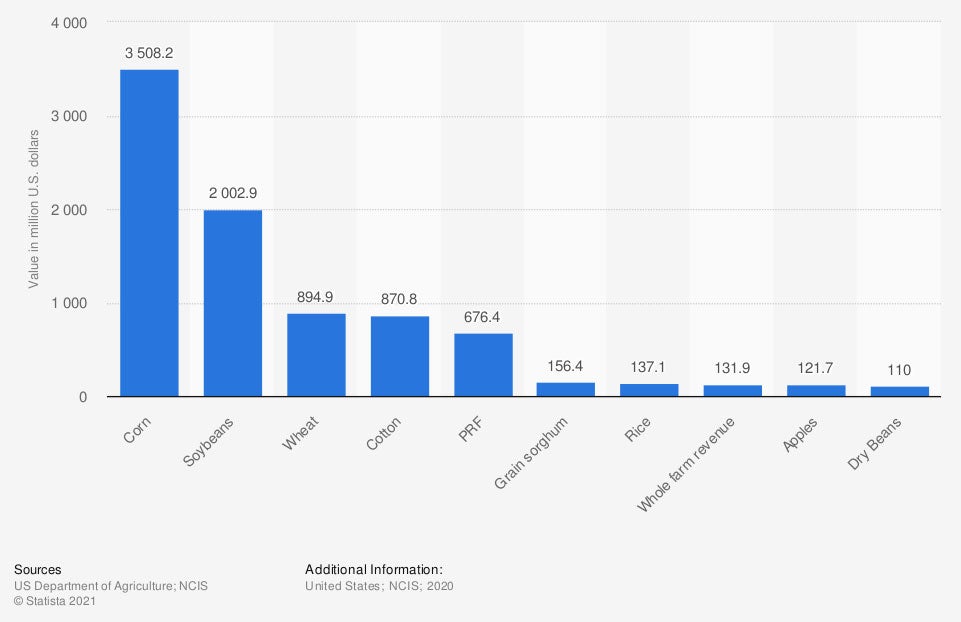

Value of crop insurance premiums in the US, by crop

Corn is by far the most valuable crop in the US, with a reported $3.5 billion in crop insurance premiums annually. Next-highest are soybean crops, at $2 billion, and wheat at $894 million.

Knowing which crops are the most valuable and expensive to insure can help you prepare your budget when hunting for crop insurance with your New Jersey independent insurance agent.

What Are Some Additional Benefits Crop Insurance Provides?

Multi-peril crop insurance is available to provide the most comprehensive type of coverage farmers need for their crops. According to insurance expert Paul Martin, multi-peril crop insurance is designed to cover the following disasters:

- Hail and high wind damage

- Frost and flood damage

- Drought

- Fire damage

- Insect damage

- Disease outbreaks

Multi-peril crop insurance is the most popular choice among farmers nationwide for the numerous benefits it provides. A New Jersey independent insurance agent can further explain the benefits offered by multi-peril crop insurance, and help you decide if this is the right type of coverage for you.

Crop Insurance vs. Farm Insurance

Crop insurance is just one aspect of a complete New Jersey farm insurance package. In addition to crop coverage, farm insurance policies also provide the following protections:

- Liability coverage: Farmers need protection against lawsuits filed by visitors, guests, and other third parties who come to their premises.

- Livestock coverage: A farm’s livestock is another important component that needs protection from many threats like theft, fire, and more.

- Property coverage: Buildings, fences, tools, and other physical property on farms need protection against storm damage, vandalism, etc.

A New Jersey independent insurance agent can help your farm get protected from every angle with the right farm insurance policy.

Here’s How a New Jersey Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect farmers against commonly faced liabilities. New Jersey independent insurance agents shop multiple carriers to find providers who specialize in crop insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

https://www.statista.com/statistics/723049/value-of-crop-insurance-premiums-usa-by-crop/

https://www.iii.org/article/understanding-crop-insurance

https://www.irmi.com/term/insurance-definitions/multi-peril-crop-insurance

© 2025, Consumer Agent Portal, LLC. All rights reserved.