Your responsibility for your boat doesn't end when you dock it at sundown. Any incidents that happen while your boat's docked can also be on you. So what happens if your boat damages another at a marina?

While a New Jersey independent insurance agent can help by getting you equipped with the right boat insurance, it's also important to know the answer to this question. Here's a breakdown of if and when you're responsible for your boat damaging another.

Who’s Responsible If My Boat Damages Another at a Marina in New Jersey?

It really depends on the cause of the disaster that led to you damaging another boat. Consider the following scenarios:

- You failed to maintain your boat and it caught on fire: You'd be held responsible for a fire that broke out on your boat due to your own negligence.

- You didn't dock your boat properly: If you loosely tied your boat to the dock and then it bumped another, you'd also be held responsible.

- You intentionally caused damage to property: If you used your boat to intentionally damage the marina or other boats docked there, you'd be held responsible.

The difference in these scenarios is that while your boat insurance would be likely to cover you for the first two, it wouldn't for the last one. Insurance never covers intentional malicious acts against others or their property.

What Does Boat Insurance Cover in New Jersey?

Boat insurance protects you and your vessel similarly to how car insurance protects you and your vehicle. Though policies vary depending on the coverages you select, there are several core protections offered most often.

Boat insurance in New Jersey provides the following main coverages:

- Personal property damage: Protects your boat, trailer, and engine if they get damaged by covered perils like fire, vandalism, etc.

- Property damage liability: Reimburses for property damage, such as to other boats, that's caused by your boat.

- Bodily injury liability: Reimburses for treatment costs for injuries to third parties who get harmed by your boat.

- Medical payments: Reimburses the cost of medical treatment for you and your passengers who get hurt by your boat or while on your boat.

If you file a claim through boat insurance, you'll have to pay the deductible amount out of your own pocket before your coverage starts reimbursing you. Afterwards, you'll be covered up to your policy's limit in that category, such as bodily injury liability, for your claim amount.

What Doesn't Boat Insurance Cover in New Jersey?

Boat insurance protects against many catastrophes, but it has its exclusions as well.

Boat insurance typically doesn't cover:

- Business watercraft: Boats that are used for business purposes must be covered by commercial watercraft insurance or marine business insurance.

- Intentional acts: Again, you won't be covered by your boat insurance, or any other type of policy, for malicious or intentional acts against others or their property.

- Non-owned watercraft: Rented watercraft aren't often covered by standard boat insurance, but endorsements are available to add this coverage to your policy.

Work with a New Jersey independent insurance agent to get your watercraft equipped with all the boat insurance it needs.

Will My Insurance Fully Cover the Damage to My Boat, Too?

If your boat insurance includes personal property damage coverage, then the answer is yes. However, not all boat insurance policies automatically come with this coverage. You'll want to double-check your specific policy with your New Jersey independent insurance agent.

You'll also still have to pay your deductible amount before you receive any reimbursement. Afterwards, if your boat was damaged due to a listed incident, you should be covered for the rest by your policy. You'll also want to be familiar with your coverage limits in each category of your boat insurance.

What If You Don’t Own the Boat?

If you've borrowed a friend's boat, you may still be covered under their boat insurance policy. Different policies have different rules about which additional operators are covered, and some restrict it to only immediate family. If that was the case for your friend's policy, you wouldn't be covered by their insurance.

If you're on vacation and are using a resort's boat, you'll want to make sure you're covered by a boat rental policy. Many resorts and other businesses that rent out boats require their customers to get this coverage first, anyway. If you're unsure of what protection you need when using someone else's boat, talk with your New Jersey independent insurance agent.

Is Yacht Insurance the Same as Boat Insurance?

Yachts require their own type of policy to protect them. Yachts are classified as boats that are 27' in length or larger, and they're often not covered by a regular boat insurance policy. Many yacht insurance policies have similar coverages to boat insurance, including bodily injury liability, but they can also include broader protections, since they typically travel farther than other boats.

Yachts are not only more expensive to purchase and own, they're also more expensive than smaller boats to insure. Yacht policies can range from $3,000 to $150,000 annually, depending on the size and value of your vessel. A New Jersey independent insurance agent can get you covered by yacht insurance if you own a larger watercraft.

Is Boat Insurance Mandatory in New Jersey?

All states have different laws and regulations regarding boat insurance. New Jersey does require boaters to register their vessels. However, boat insurance is not mandatory by law. But whatever the state's requirements, having coverage is very important.

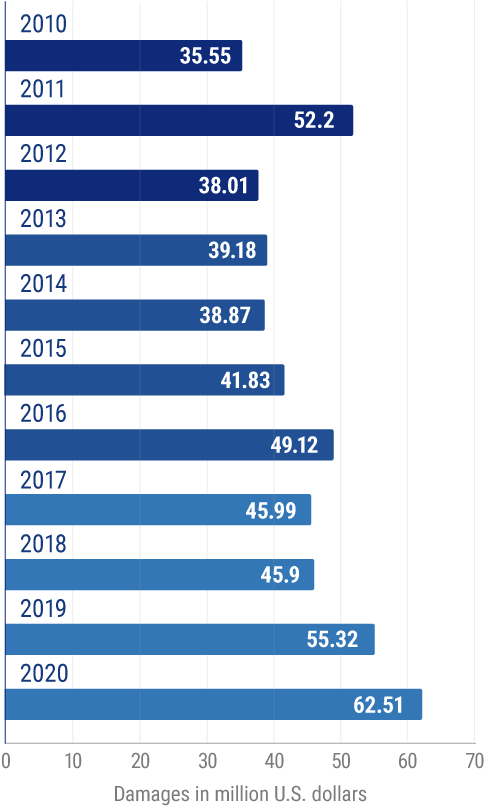

Total damage caused by recreational boating accidents in the US

Not only are recreational boating accidents getting more frequent over time, they're also getting more expensive. In one recent year, the total damage caused by recreational boating accidents nationwide came to $62.5 million. That's quite an increase from 20 years earlier, when damage from recreational boating accidents totaled $31.3 million. In fact, boating accident costs have nearly doubled since then.

Having the right boat insurance is critical to protect you from having to pay hefty costs out of your own pocket in case of an incident. Whether your boat is being operated out on the open water or it's docked at the marina, accidents can happen. But the right coverage could save you a great deal of money, not to mention stress.

Why Choose a New Jersey Independent Insurance Agent?

New Jersey independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

New Jersey independent insurance agents also have access to multiple insurance companies, ultimately finding you the best boat insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

https://uscgboating.org/library/accident-statistics/Recreational-Boating-Statistics-2020.pdf

https://www.statista.com/statistics/240641/recreational-boating-accidents-in-the-us-total-damages/

https://www.discoverboating.com/ownership/insurance

https://robbreport.com/lifestyle/finance/boat-insurance-1234642910/

https://www.discoverboating.com/ownership/insurance#:~:text=Yacht%20coverage%20tends%20to%20be,as%20the%20operator%20and%20passengers.

https://www.godownsize.com/yacht-insurance-prices-2/

https://anthonycarbonepersonalinjurylawyer.com/do-you-need-boat-insurance-in-new-jersey/

© 2025, Consumer Agent Portal, LLC. All rights reserved.